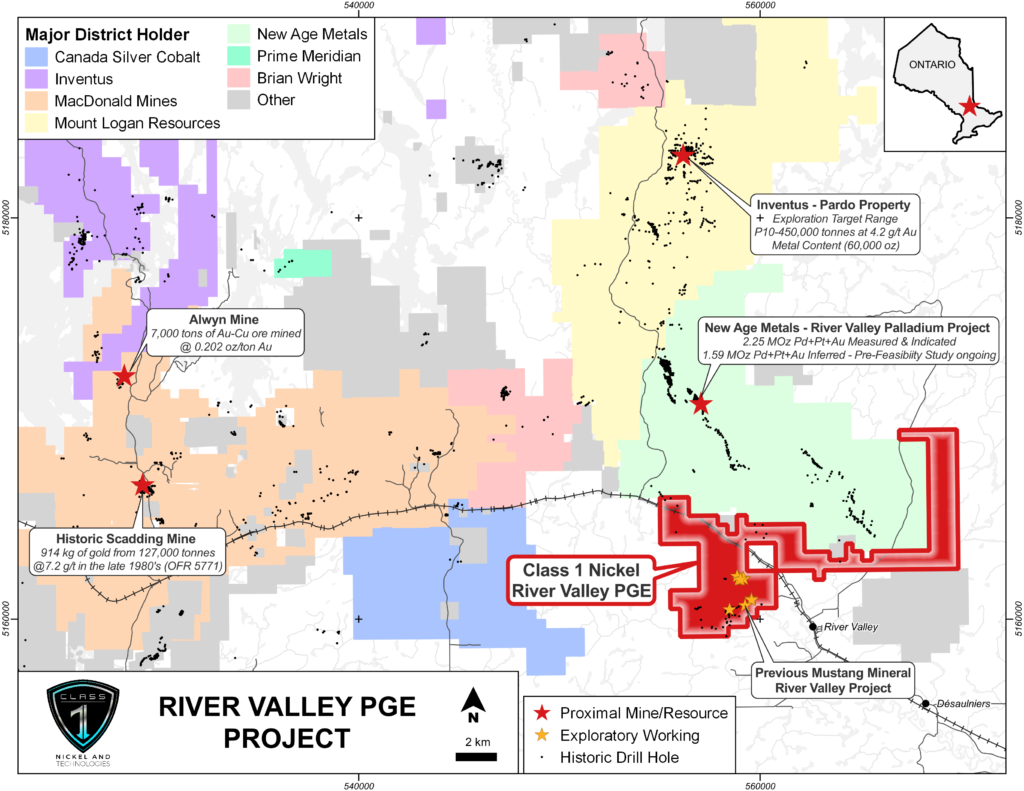

Toronto, Ontario (13 December 2023) – Class 1 Nickel and Technologies Ltd. (CSE: NICO | OTCQB: NICLF) (“Class 1 Nickel” or the “Company”) is pleased to provide an update on its nickel exploration and operations for its 100% owned Alexo-Dundonald (Ontario) and Somanike (Quebec) nickel projects. Both projects comprise extensive property packages covering past-producing nickel mines, offering near-term production opportunity and excellent exploration upside. The Company also holds 100% interest in its River Valley PGE Project located about 65 km northeast of the City of Sudbury, the world’s largest and longest operating nickel-copper-cobalt-PGE mining camp.

Table 1 provides a summary of the work completed to date by Class 1 Nickel on the highly prospective Alexo-Dundonald and Somanike nickel projects.

The Alexo-Dundonald Nickel Project (“A-D Project”), is located about 45 km northeast of the City of Timmins, Ontario, covers an area of approximately 1,895 hectares (18.95 km2) and was acquired by the Company in September 2018. The A-D Project includes four foundation nickel deposits (Alexo North and South and Dundonald North and South) of which the Alexo North and Alexo South (aka Kelex) were small-scale past producers of nickel (i.e., 1957; 2004-2005). The deposits are located on a near-continuous folded komatiite-ultramafic rock sequence that extends for at least 14 kilometres within the Property. The four mineral resources (Tables 2 and 3) are open at depth and along strike and could increase in size with additional drilling.

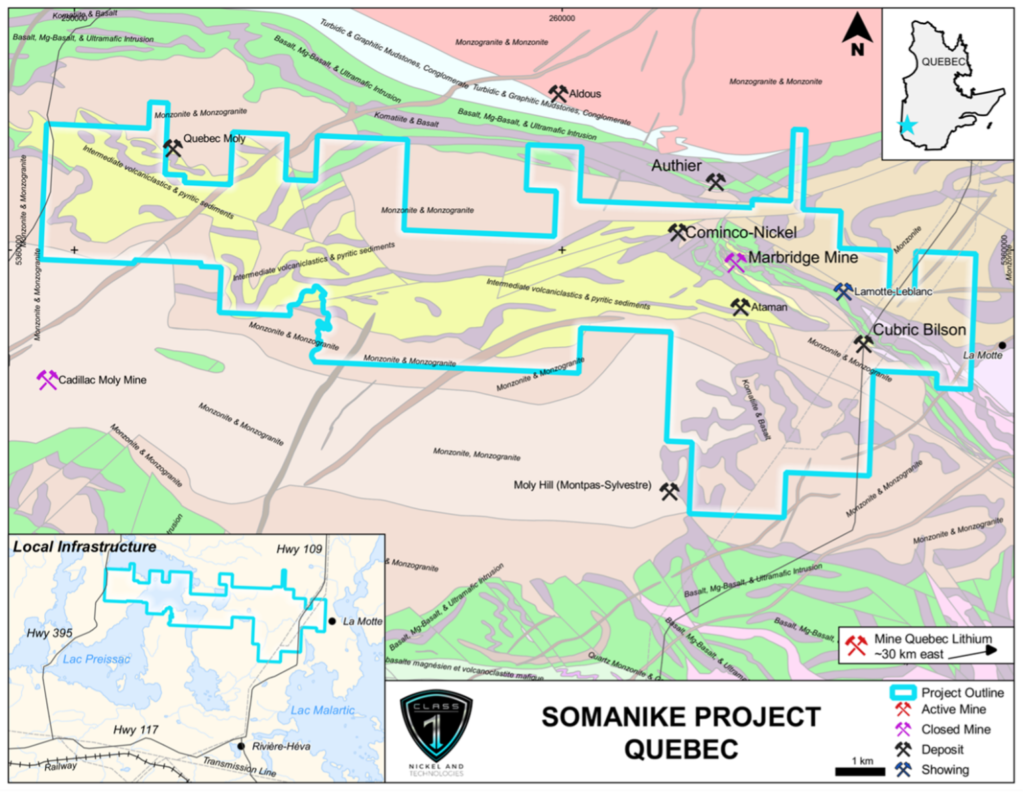

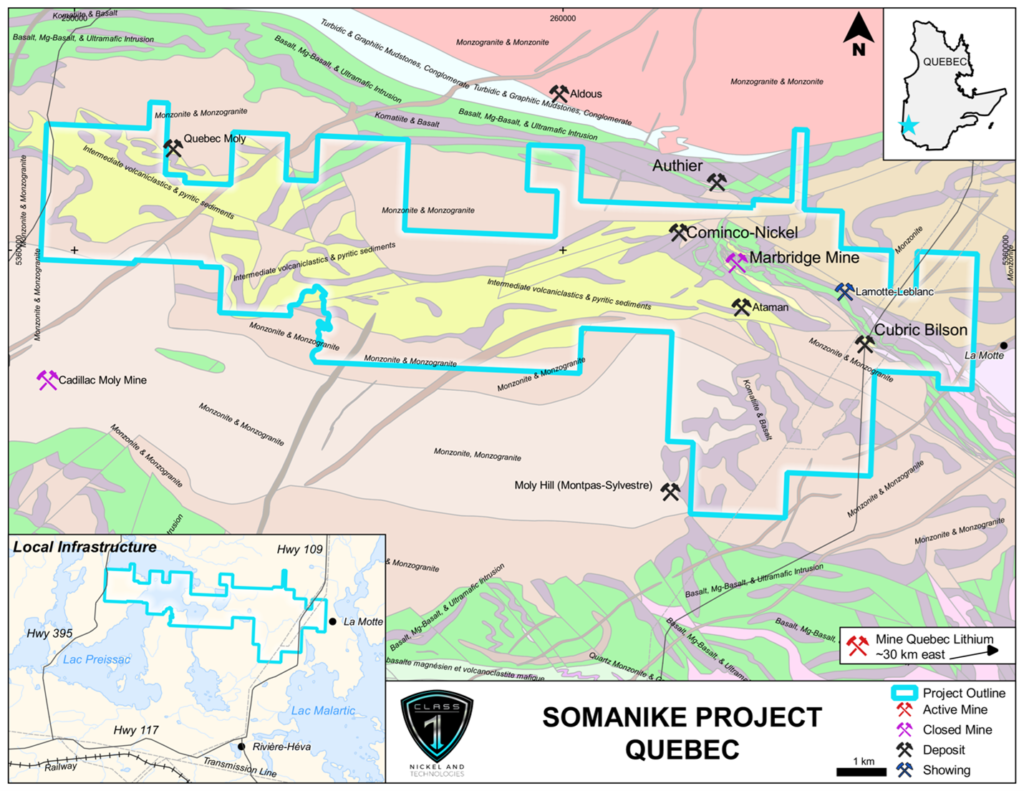

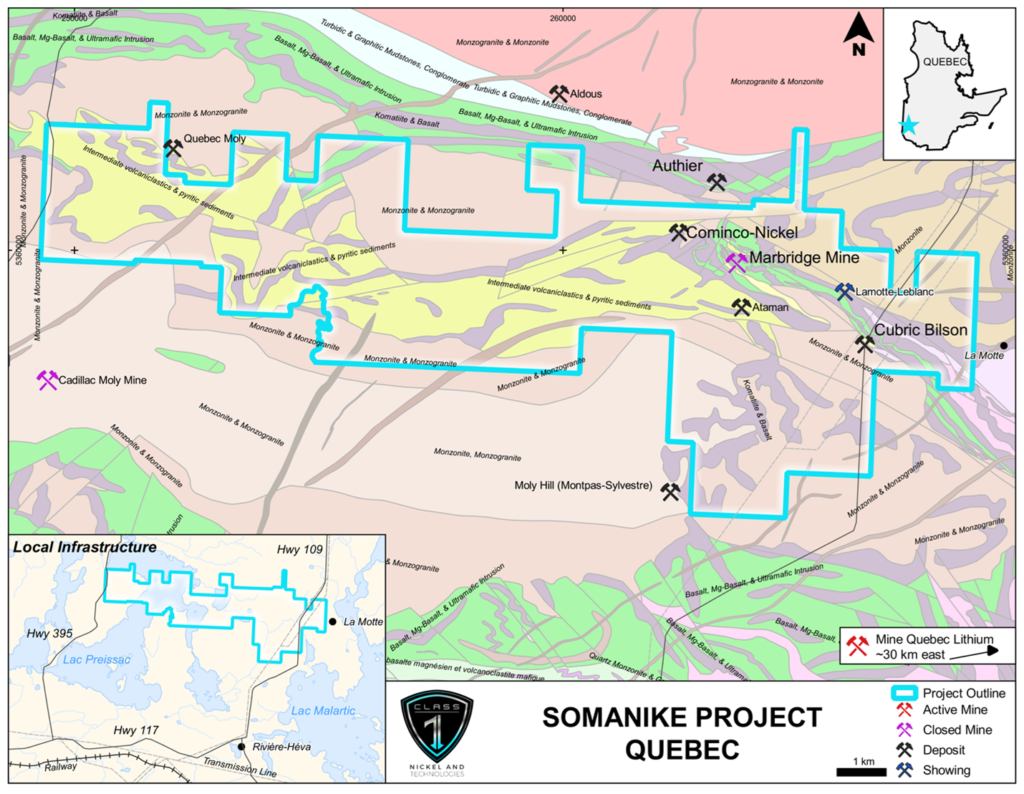

The Somanike Nickel Project (“Somanike”), located about 25 km north of the mining centre of Malartic and 40 km northwest of Val d’Or, covers an area of approximately 6,882 hectares (68.8 km2) and was acquired by the Company in February 2021. The Somanike includes the past-producing high-grade nickel Marbridge Mine which ceased production in 1968.

OPERATIONS UPDATE

Class 1 has engaged Caracle Creek Chile SpA (Canada/Chile) and their strategic partner Atticus Geoscience Consulting Ltd. (UK/Peru) (the “Consultants”) to conduct overarching independent reviews of both the A-D and Somanike nickel projects but with an initial focus on the Alexo-Dundonald Nickel Project and its four nickel-copper-cobalt-PGE deposits.

The work at A-D will include compilation and targeting and updating of 3D geological models with a view to produce revised mineral resource estimates, a preliminary economic assessment, and comprehensive exploration and development budgets for 2024 work programs to include:

- Compilation and verification of data, assays, inventory, and NI 43-101 reporting;

- Generating the Company’s first comprehensive 3D geological models (current), mineral resource models (2024), and pit optimisation scenarios (2024) looking toward a PEA level study or studies in 2024;

- Conducting preliminary studies into the economic viability of proposed future nickel production scenarios;

- A review of work done to date, regarding environmental studies and permitting; and

- A comprehensive diamond drilling plan to expand current mineral resources.

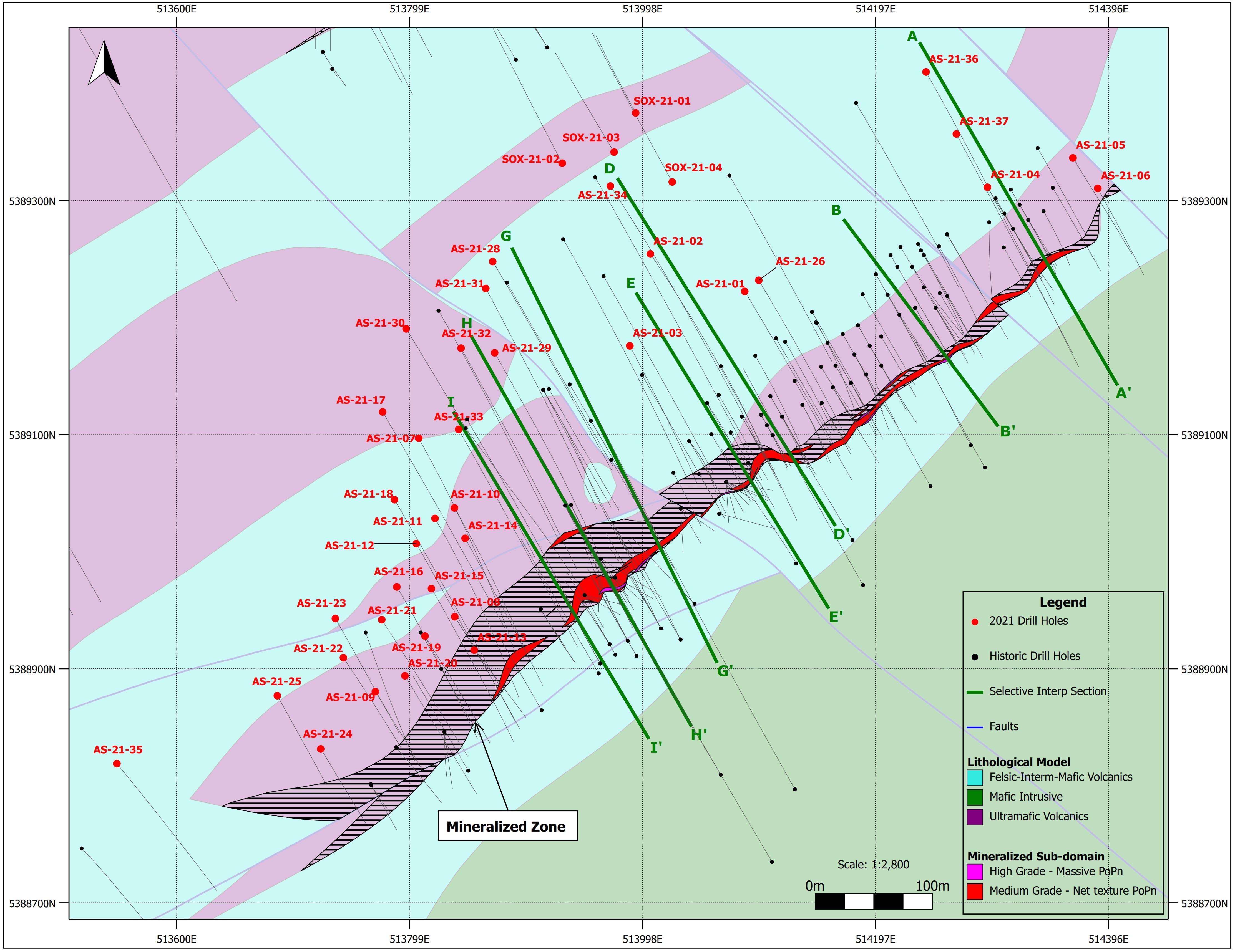

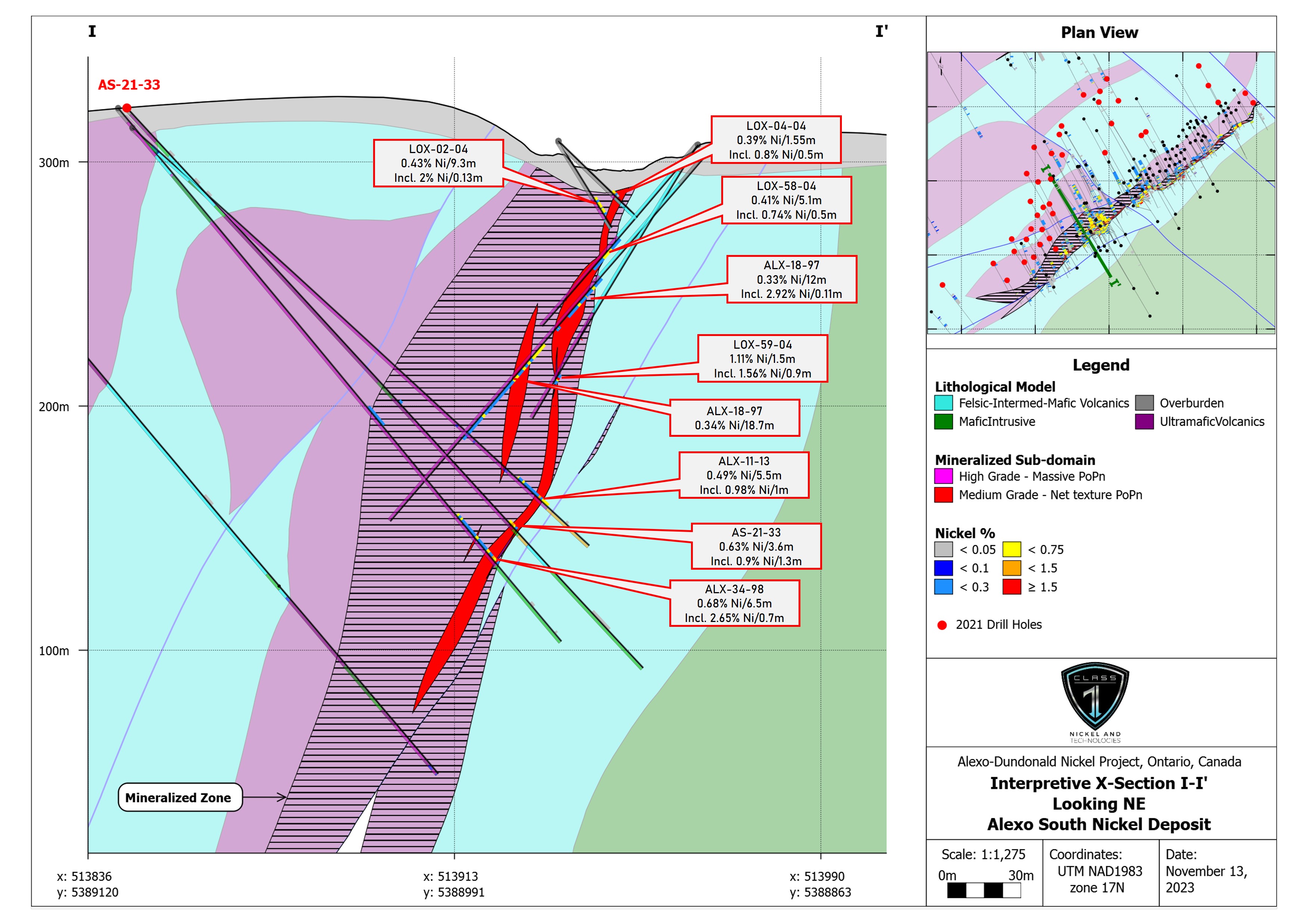

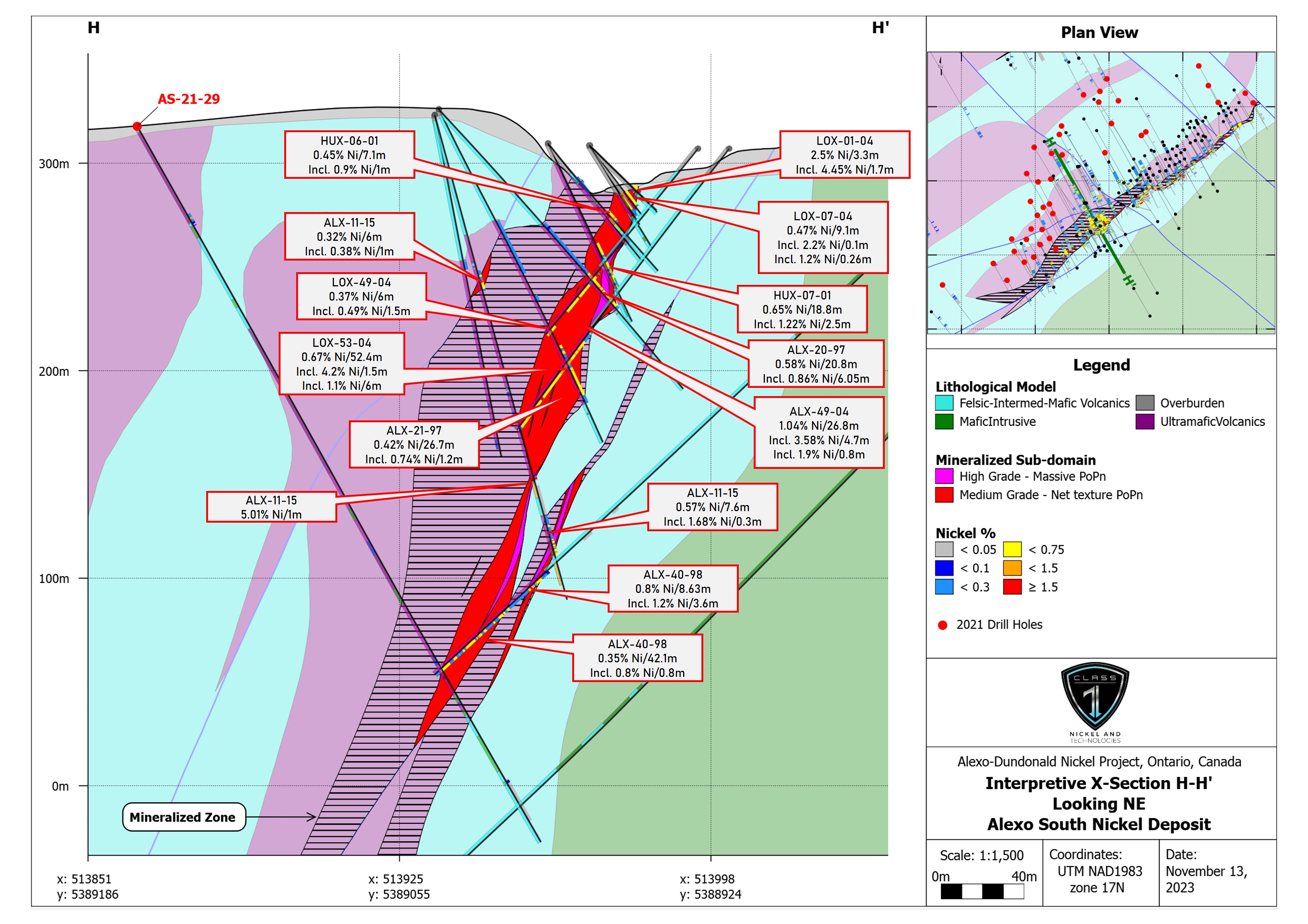

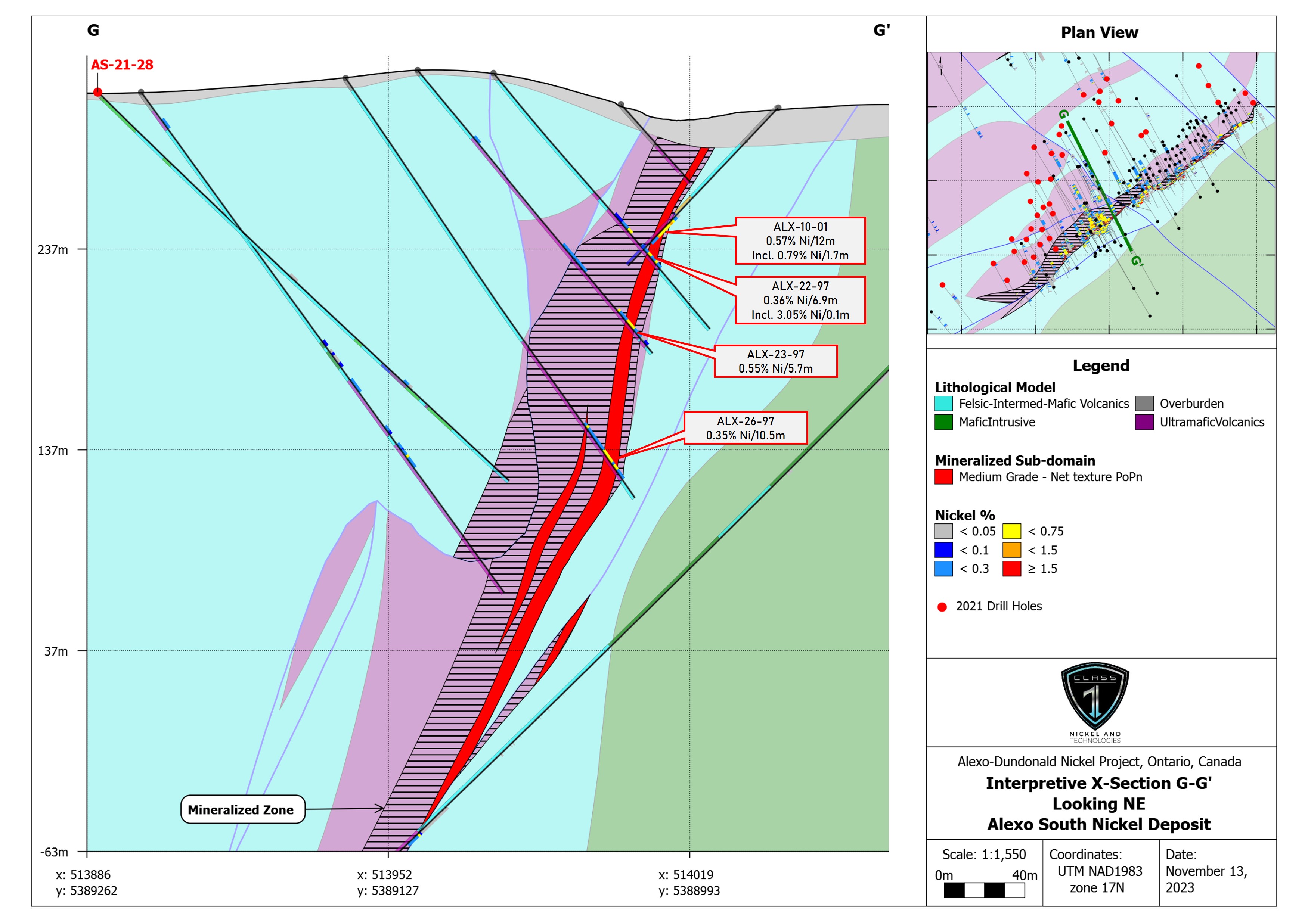

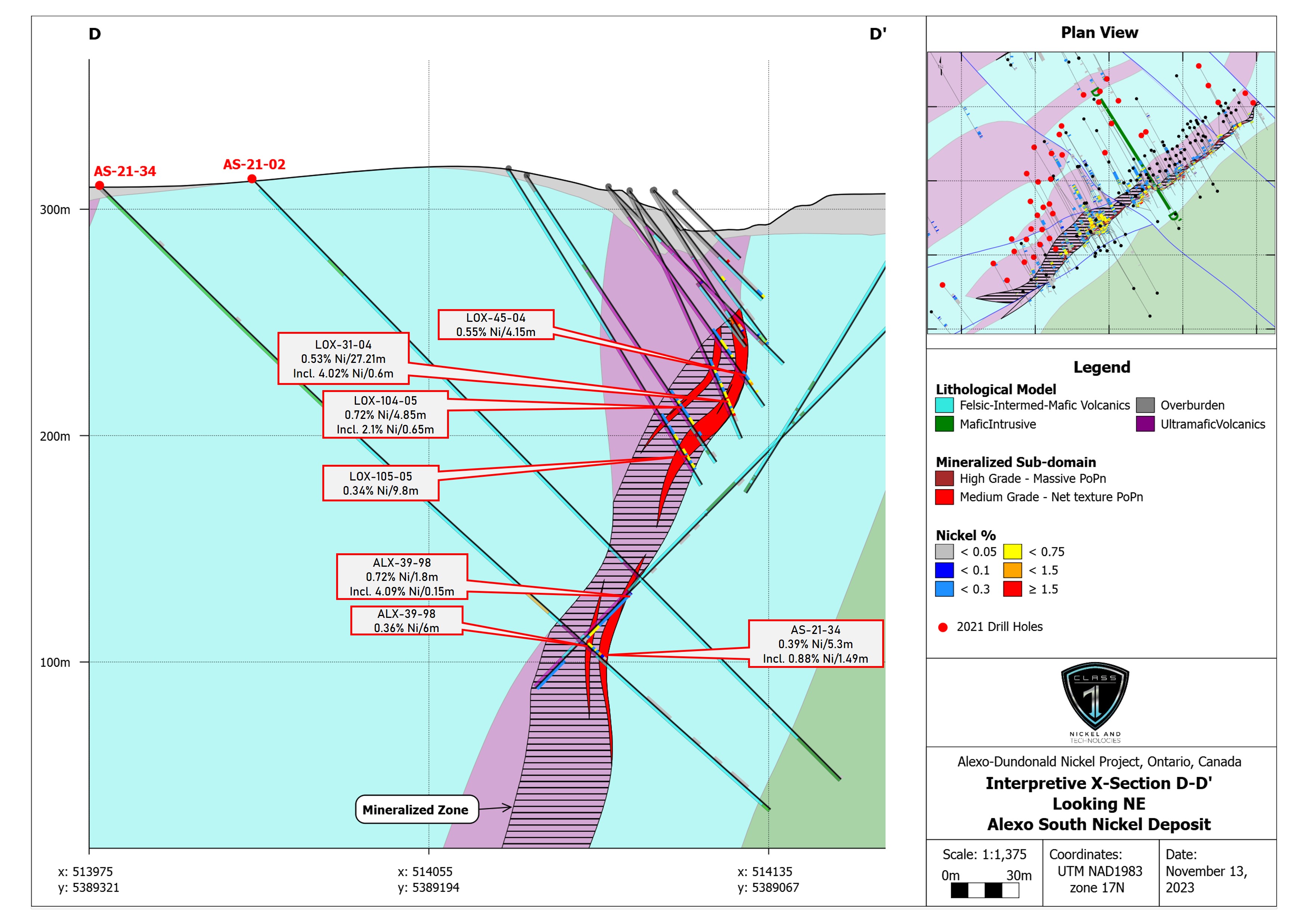

Looking toward 2024, the Company is focused on completing an updated mineral resource estimate on the Alexo South Nickel Deposit and a drilling program is being planned to test high-grade nickel shoots, expand resources, and upgrade resource categorization at Alexo South. Various cross-sections showcasing the updated geological modelling are shown in Figures 1, 2, 3, 4, and 5 (or click to view Figure 1, Figure 2, Figure 3, Figure 4 and Figure 5). The remaining three nickel deposits will also see new updated mineral resource estimates in 2024.

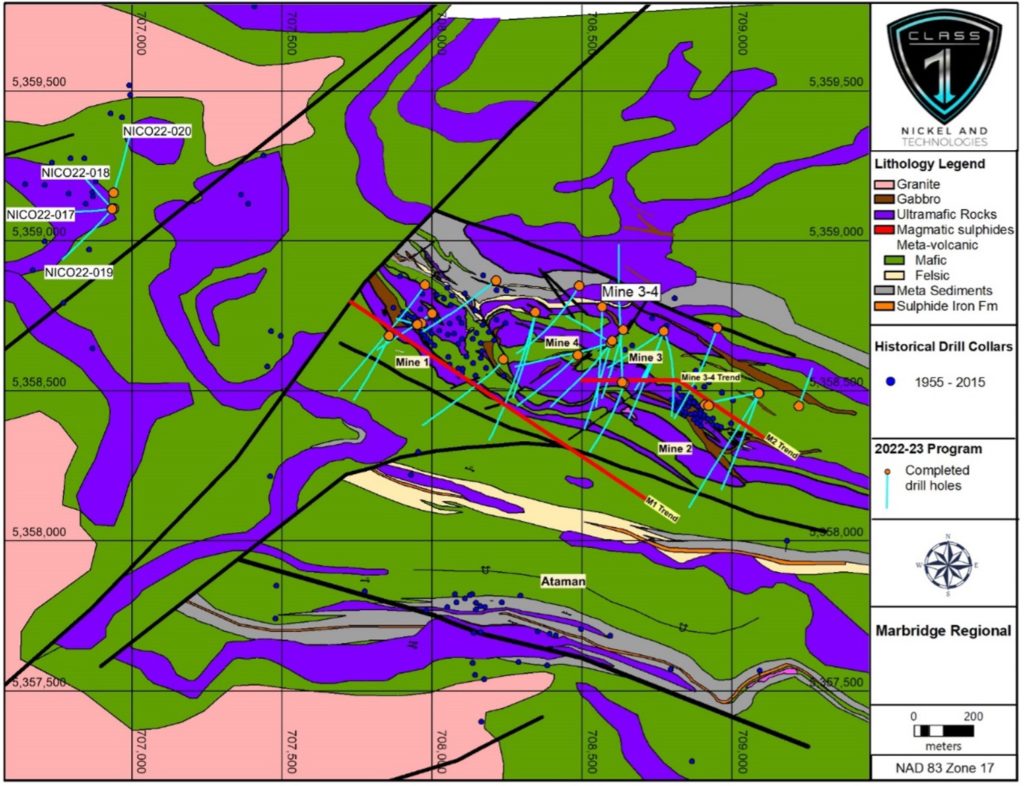

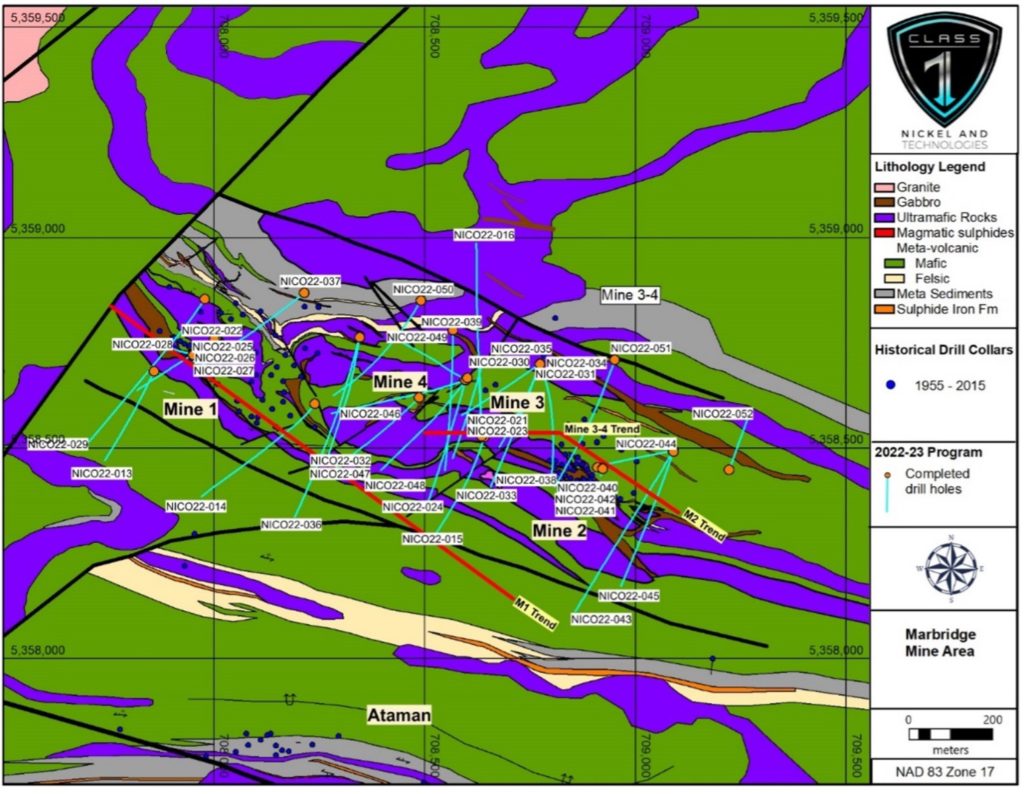

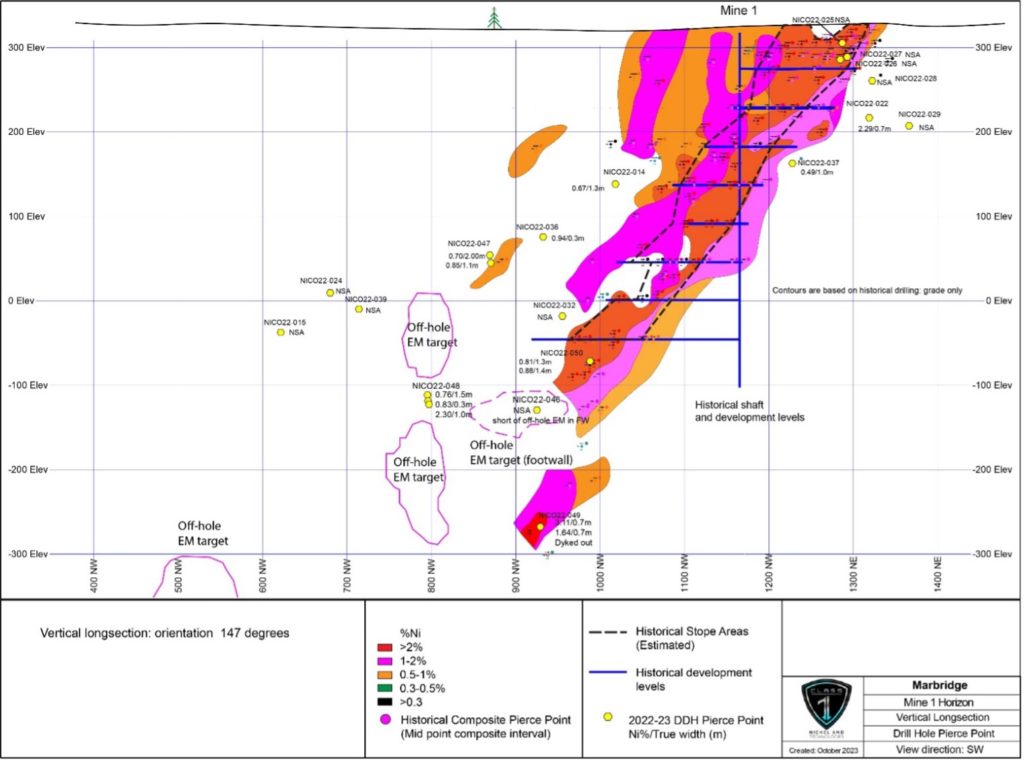

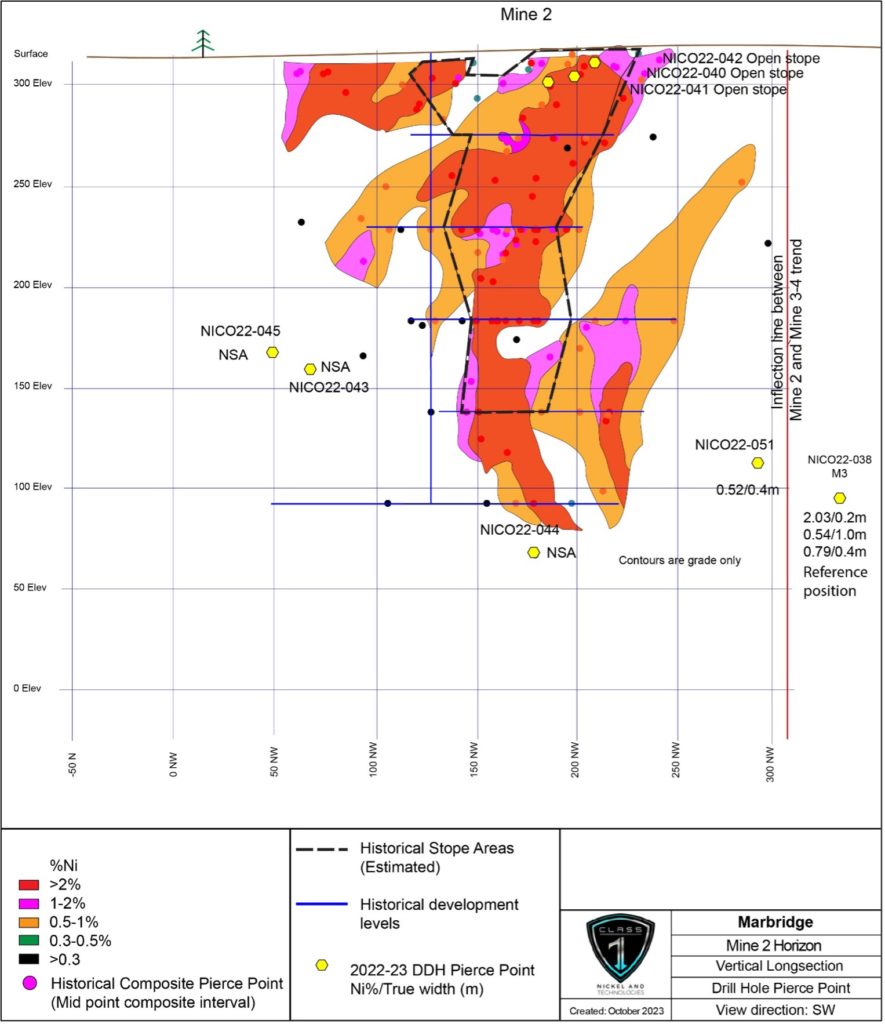

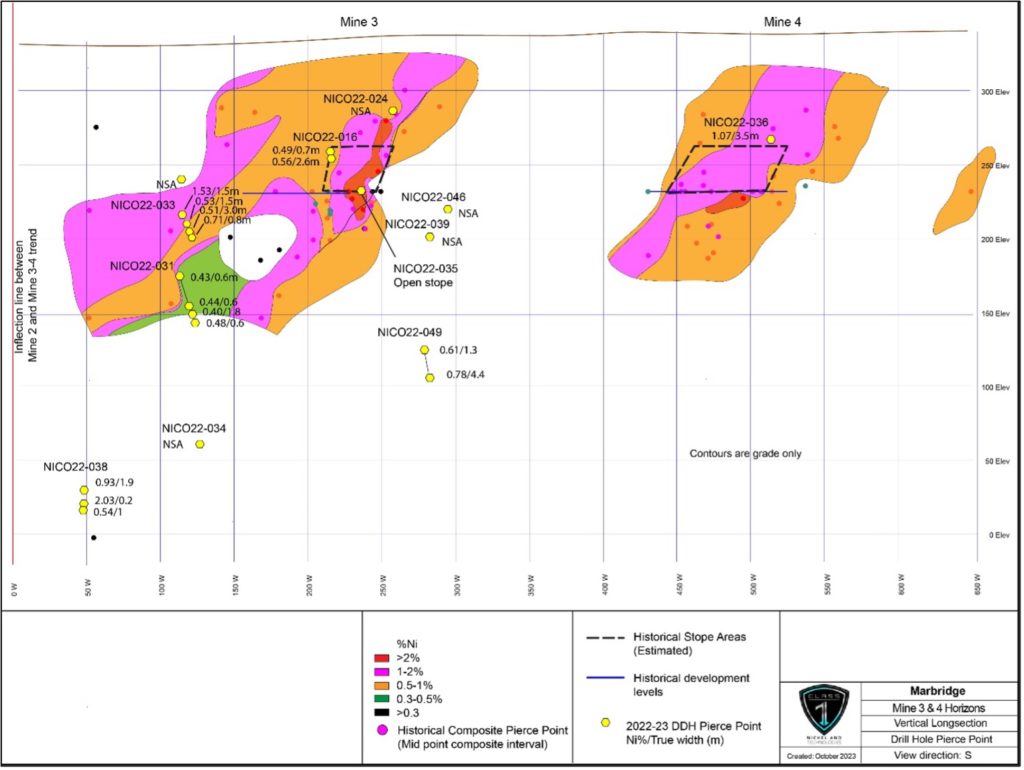

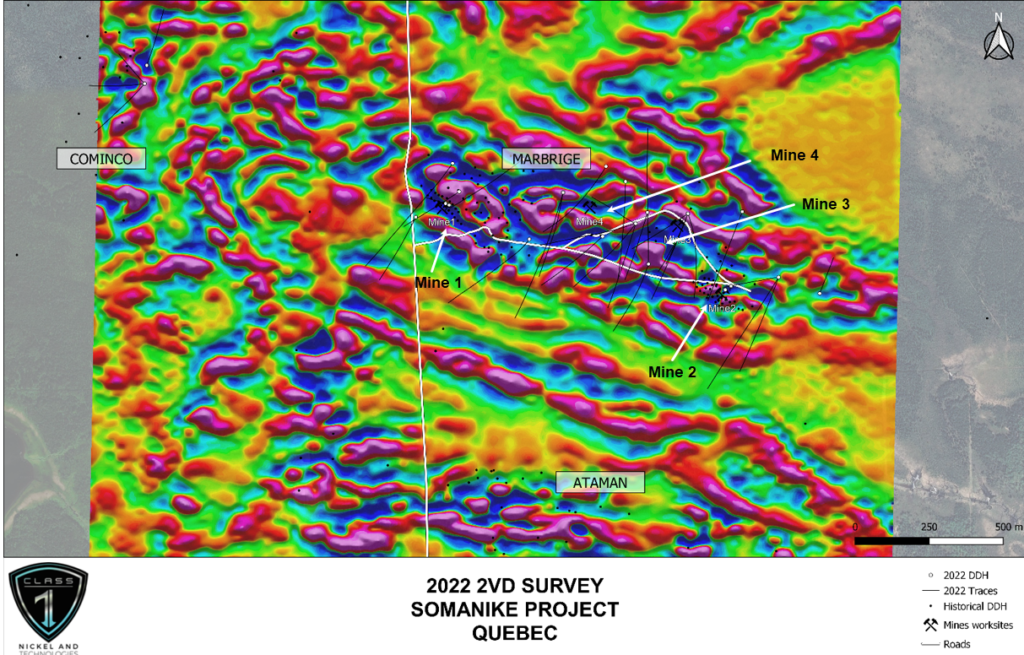

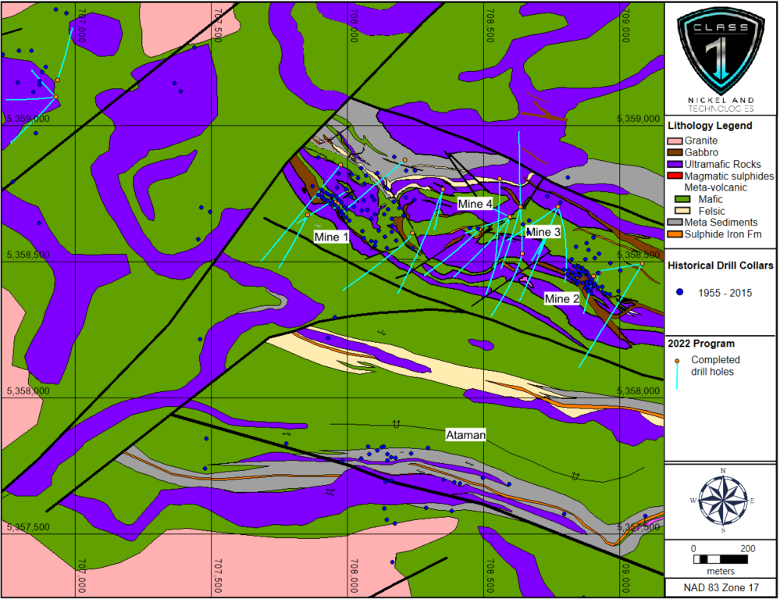

The Consultants will also be undertaking a comprehensive review of the Somanike Nickel Project (Marbridge Mine and area) in Quebec, including the integration of recent exciting successful drill hole intercepts and data from 2022-2023 exploration programs which delineated a number of new geophysical targets within the historical Marbridge Mine area. Mr. Alexandr Beloborodov (P.Geo., OGQ #01637) is the Qualified Person with respect to the Somanike Nickel Project.

Table 1. Summary of work completed to date by Class 1 Nickel at Alexo-Dundonald and Somanike.

Permits

Several provincial environmental permits are in place for the A-D Project. These include:

- 2006 Ministry of Environment Conservation and Parks (“MECP”) Industrial Sewage Works Environmental Compliance Approval (“ISW ECA”);

- MECP Permit to Take Water (“PTTW”) for the Alexo North Pit; and

- Ministry of Mines (“MINES”) production-phase closure plan (“CP”) amendment (2011).

The ISW ECA permits the existing settling and polishing ponds and allows for the seasonal discharge of effluent to the nearby receiving body of water. However, the regulations governing mine discharges have changed substantially in recent years and site-specific effluent limits will most likely be required for this Project. Therefore, an amendment to the ISW ECA will most likely be required based on these new regulatory requirements. The PTTW allows for the dewatering and maintenance dewatering of the Alexo North Pit; however, it expires in October 2024. An application for renewal of this PTTW will be submitted during the first quarter of 2024. The CP amendment (2011) covers production from the Alexo North Pit and Alexo South Pit (aka the Kelex Pit) but the Project is currently in a state of inactivity and MINES only holds ~$70,000 of financial assurance for the Project.

To put the Alexo North Pit and Alexo South Pit into production, the following would be required:

- an ISW ECA amendment application, including site-specific effluent limits, may have to be prepared and submitted to the MECP for approval (as indicated above);

- a renewal of the PTTW for the Alexo North Pit is required from the MECP;

- a PTTW for the dewatering and maintenance dewatering of the Alexo South Pit would have to be obtained from the MECP;

- a Notice of Project Status, to take the Project from a state of inactivity to production, and Notice of Material Change would have to be submitted MINES; and finally

- a CP Amendment would also be required for the new project, with the relevant amount of financial assurance submitted to MINES.

A Federal Impact Assessment and Provincial Environmental Assessments are not anticipated but this will depend on the proposed rate of production.

Figure 1. Plan map of generalized geology and mineralization at Alexo South showing the location of current (AS-21-xx holes) and historical (all others) drill hole collars and traces. The northeast-trending mineralized zone (striped lines) is a modelled domain defined by >0.12% Ni. Locations of cross-sections are shown as lettered green lines.

Figure 2. Alexo South: Cross-section I-I’ showing generalized geology and mineralization and weighted drill hole intercepts of nickel in current (AS-21-xx) and historical (all others) drill holes. The mineralized zone (striped lines) is a modelled domain defined by >0.12% Ni.

Figure 3. Alexo South: Cross-section H-H’ showing generalized geology and mineralization and weighted drill hole intercepts of nickel in current (AS-21-xx) and historical (all others) drill holes. The mineralized zone (striped lines) is a modelled domain defined by >0.12% Ni.

Figure 4. Alexo South: Cross-section G-G’ showing generalized geology and mineralization and weighted drill hole intercepts of nickel in current (AS-21-xx) and historical (all others) drill holes. The mineralized zone (striped lines) is a modelled domain defined by >0.12% Ni.

Figure 5. Alexo South: Cross-section D-D’ showing generalized geology and mineralization and weighted drill hole intercepts of nickel in current (AS-21-xx) and historical (all others) drill holes. The mineralized zone (striped lines) is a modelled domain defined by >0.12% Ni.

About Alexo-Dundonald Nickel Project

The Alexo-Dundonald Nickel Project is located within the long-established Timmins mining camp of northern Ontario, Canada, about 45 km northeast of the City of Timmins. The Project covers an area of approximately 1,895 hectares consisting of a total of 95 Boundary Cell Mining Claims, Single Cell Mining Claims, Leased Claims, and Patented Claims.

Previous exploration activity and results in the Alexo-Dundonald Project area have been extensively reviewed and documented by historical NI 43-101 technical reports (Montgomery, 2004; Harron, 2009; Puritch et al., 2010 and 2012), by a previous NI 43-101 Technical Report prepared for the Company (Donaghy and Puritch, 2020), and in the current NI 43-101 Technical Report and Mineral Resource Estimate (Stone et al., 2020). Significant drill core intersections reported therein represent the latest rounds of drilling by the last companies to drill on the various target areas within the Project (i.e., Canadian Arrow at Alexo-Kelex in 2004–2005 and 2010–2011; First Nickel at Dundonald in 2004–2005; and Falconbridge at Dundeal in 1989) and are presented as an indication of nickel grade and continuity of mineralisation typical of the komatiite-hosted nickel sulphide mineralization on the Property.

The Alexo-Dundonald Nickel Project contains current mineral resources in four separate deposits: Alexo North, Alexo South, Dundonald North, and Dundonald South (see Company news release dated 17 December 2020) (Tables 2 and 3).

The current Mineral Resource Estimates (Tables 2 and 3) were prepared by Yungang Wu (P.Geo.) and Eugene Puritch (P.Eng., FEC, CET) of P&E Mining Consultants Inc, both Independent Qualified Persons as defined by NI 43-101 Standards of Disclosure for Mineral Projects.

For more information, please refer to the current NI 43-101 Technical Report and Mineral Resource Estimates on the Alexo-Dundonald Nickel Project (Stone et al., 2020) posted to the Company’s SEDAR+ profile on 17 December 2020.

About Somanike Nickel Sulphide Project

The Somanike Nickel Sulphide Project is located in the prolific and mining-friendly Abitibi Region of northwestern Quebec approximately 25 km north of the mining centre at Malartic, 40 km northwest of Val-d’Or, and 60 km east of Rouyn-Noranda. The Project consists of 148 mining titles (6,882 ha) over the large northwest-trending La Motte Ultramafic Complex, within the Abitibi Greenstone Belt. The ultramafic rocks host several nickel sulphide occurrences, recognized nickel targets (geophysical and geological), and areas of historical high-grade nickel production (Marbridge Ni-Cu Mine).

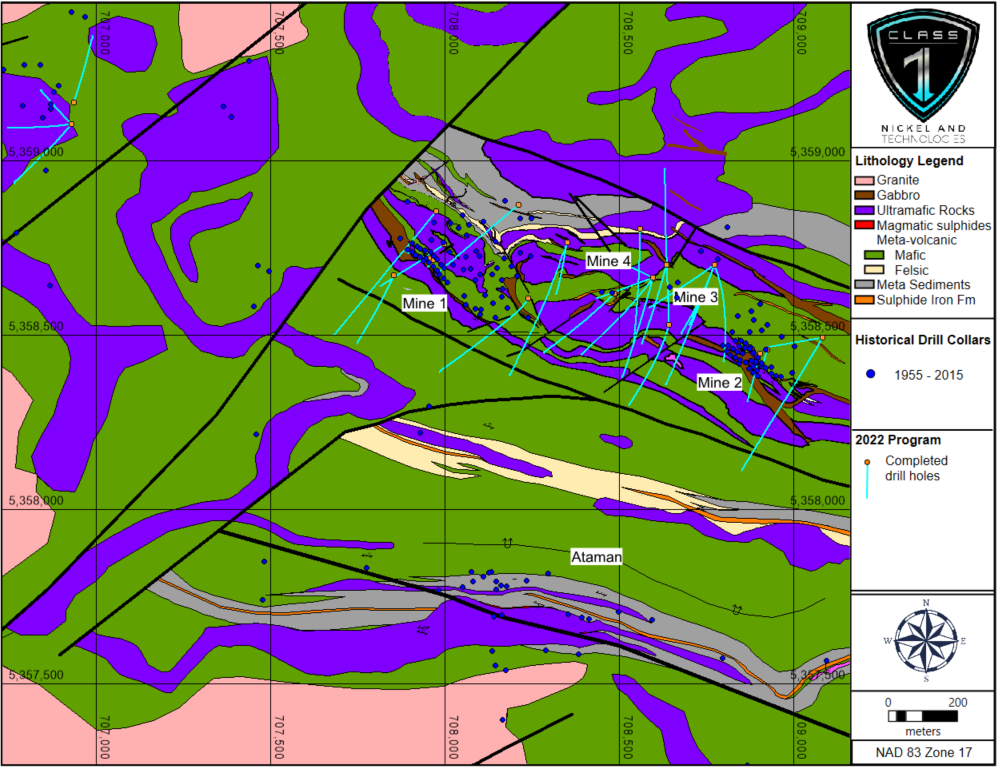

The Somanike Nickel Sulphide Project includes Quebec’s first nickel mine, the historical Marbridge Ni-Cu Mine (the “Marbridge”), operated by Falconbridge Nickel from 1962 to 1968, which produced high-grade nickel and secondary copper. The Marbridge occurs within the northwest-trending La Motte Ultramafic Complex which comprises deformed and altered ultramafic rocks. Falconbridge Nickel reported production of 702,366 tons grading 2.28% Ni and 0.10% Cu, prior to being placed on care and maintenance in 1968 (source: SIGEOM, MERN Quebec Government website).

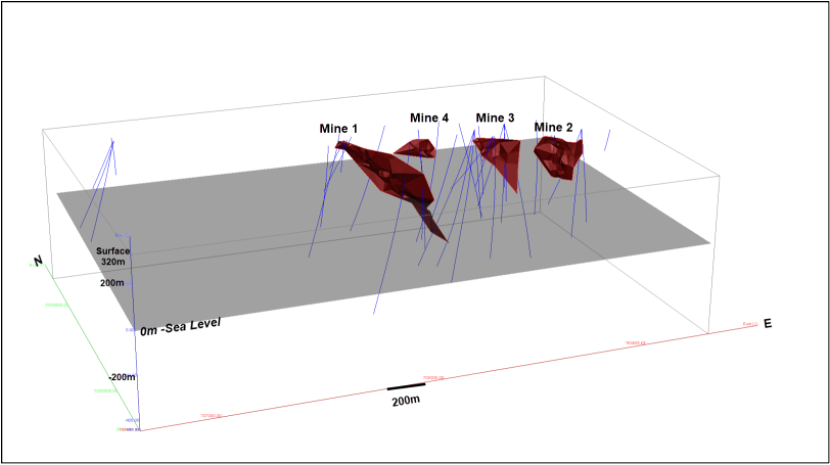

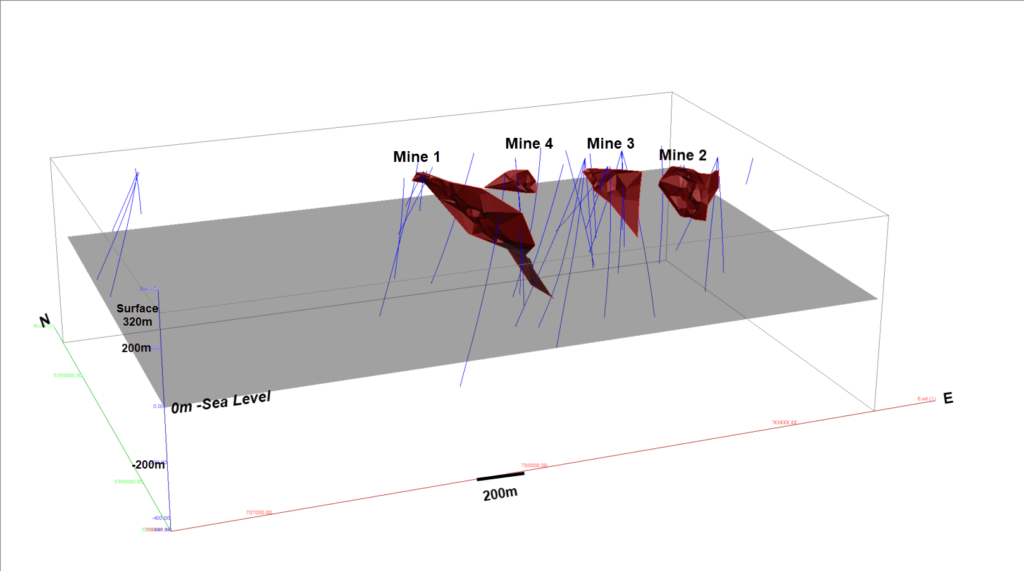

The Marbridge consists of two shafts that accessed four separate mineralized zones (horizons) over a combined strike length of 1,000 metres. During production, mineralized material was trucked 25 km south to the Canadian Malartic processing plant. Mining in 1968 ceased in mineralization and the four nickel sulphide zones or mineralized horizons (Mine 1, Mine 2, and Mine 3-4) remain open to expansion along strike and down-dip/plunge.

QA/QC and Assay Protocols

Core and QAQC samples from the Alexo-Dundonald drilling program were sent to AGAT Laboratories in Mississauga, Ontario. At AGAT Laboratories, the analytical methods employed consisted of four-acid digest followed by sodium peroxide fusion and ICP-OES finish for multi-element analysis (including Ni, Cu, Co and S); fire-assay collection and ICP-OES finish for palladium, platinum and gold; and nickel collection fire assay and ICP-MS finish for the platinum-group elements, including rhodium. AGAT is recognized by the industry and accredited with Standards Council of Canada (SCC), Canadian Association for Laboratory Accreditation (CALA), British Standards Institution Canada (BSI), and for specific tests by ISO/IEC 17025:2017 standards and certified to ISO 9001:2015.

Core and QAQC samples from the Somanike drilling programs were sent to Impact Global Solutions Inc.’s laboratory in Delson, Québec (“IGS”) for analysis by a 50 element assay package of 4 Acid Digestion, Ore Grade Metals Package, with ICP-OES finish and precious metals (Pt, Pd, Au) by fire assay. IGS is recognized by the industry and accredited with the Standards Council of Canada and certified for specific tests by ISO/IEC 17025 standards.

In addition to the QA/QC employed by the commercial laboratories, Class 1 Nickel uses its own rigorous QA/QC protocols for sampling which includes the insertion of certified reference material standards, sample duplicates, and coarse silica blanks into the sample stream on a systematic basis. In all cases, core samples were collected from NQ-size drill core, sawn in half using a diamond saw, with one-half of the core sent to the laboratory and the other half stored at a secure site for future reference.

Qualified Person

Technical information and data in this news release has been reviewed and approved by Dr. Scott Jobin-Bevans (P.Geo., PGO #0183), a geological consultant to the Company, and a Qualified Person under the definitions established by National Instrument 43‐101.

About Class 1 Nickel

Class 1 Nickel and Technologies Limited (CSE: NICO | OTCQB: NICLF) is a Mineral Resources Company focused on the exploration and development of its 100% owned komatiite-hosted Somanike Ni-Cu Sulphide Project in Quebec, which includes the historical Marbridge Ni-Cu Mine. The Company also owns the Alexo-Dundonald Ni-Cu-Co Sulphide Project, a portfolio of komatiite-hosted magmatic sulphide deposits located near Timmins, Ontario.

For more information, please contact:

Mr. David Fitch, President & CEO

T: +61.400.631.608

For additional information please visit our website at www.class1nickel.com and our Twitter feed: @Class1Nickel.

Neither the Canadian Securities Exchange nor its regulation services provider has reviewed or accepted responsibility for the adequacy or accuracy of this press release.

This news release contains forward-looking information which is not comprised of historical facts. Forward-looking information is characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate” and other similar words, or statements that certain events or conditions “may” or “will” occur. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, and opportunities to differ materially from those expressed or implied by such forward-looking information. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, changes in the state of equity and debt markets, fluctuations in commodity prices, delays in obtaining required regulatory or governmental approvals, and other risks involved in the mineral exploration and development industry, including those risks set out in the Company’s management’s discussion and analysis as filed under the Company’s profile at www.sedarplus.ca. Forward-looking information in this news release is based on the opinions and assumptions of management considered reasonable as of the date hereof, including that all necessary governmental and regulatory approvals will be received as and when expected. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information. The Company disclaims any intention or obligation to update or revise any forward-looking information, other than as required by applicable securities laws.