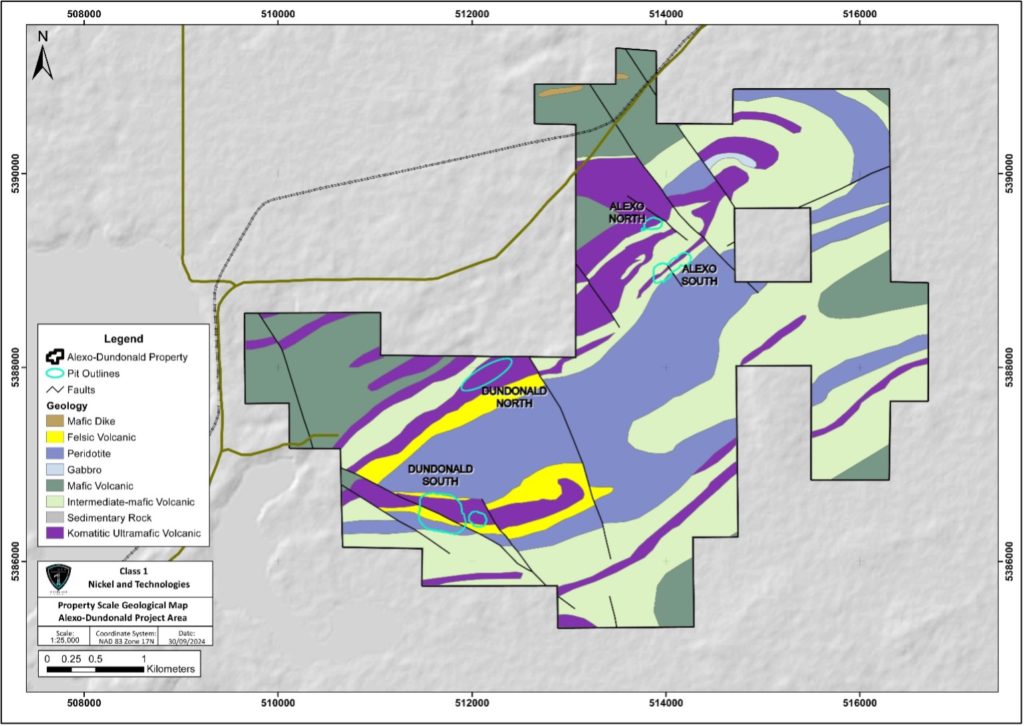

Toronto, Ontario (3 Oct 2024) – Class 1 Nickel and Technologies Ltd. (CSE: NICO | OTCQB: NICLF) (“Class 1 Nickel” or the “Company”) is pleased to announce an updated mineral resource estimate (the “MRE”) for the Dundonald South Nickel Deposit (the “D-S Deposit”) (Table 1 and Table 2). The D-S Deposit is one of 4 nickel deposits within the sizeable Alexo-Dundonald Nickel Sulphide Project (the “Project” or “A-D Project”) (Figure 1), located about 45 km northeast of the City of Timmins, Ontario, and covering about 1,895 hectares (18.95 km2).

- Indicated Resources (Pit-Constrained*) of 2.54 Mt at 0.49% Ni (27.4 Mlbs Ni) – 781% increase in Indicated tonnes and 474% increase in nickel pounds.

- Dundonald South Deposit contains 776,000 t at 1.0% Ni using a 0.67% Ni cut-off (17.1 Mlbs nickel).

- Total Mineral Resources within 4 deposits: 3.4 Mt at 0.54% Ni Indicated and 5.9 Mt at 0.61% Ni Inferred.

- 87% of the nickel pounds and 41% of the tonnes (Pit-Constrained + Out-of-Pit) in the Dundonald South Deposit are in the Indicated category with drilling planned to update to Measured.

- With 59% of the Dundonald South Deposit tonnes in the Inferred category there is excellent exploration upside to expand and upgrade resources through additional drilling.

- Like the other 3 nickel deposits within the Project, the Dundonald South Deposit is open along strike and at depth, with new geological modelling and interpretation providing ample targets for next-stage drilling.

*C$52.50/t NSR Pit-Constrained and C$96.00/t NSR Out-of-Pit cut-offs applied in current 2024 mineral resource estimates whereas C$30.00/t NSR Pit-Constrained and C$90.00/t NSR Out-of-Pit cut-offs were applied in the 2020 mineral resource estimate (Dundonald North Deposit).

David Fitch, CEO of Class 1 Nickel, commented: “These new results from the updated mineral resource estimate for Dundonald South are extremely positive and the re-interpreted model shows off the high-grade nickel sulphide potential of this deposit and gives us several new areas to target in future drilling programs. Dundonald South contains some very high-grade nickel assays over significant intervals, demonstrating the capability of these Komatiite-hosted nickel sulphide deposits to contain potentially economic nickel without considering as yet the precious metal contents such as platinum and palladium. Having 3 of the 4 nickel deposits’ mineral resources updated gets us closer to developing a comprehensive Phase 2 drilling program and helps guide us toward the ensuing goal of completing our first Preliminary Economic Assessment.”

The updated MRE for the D-S Deposit was completed by Atticus Geoscience Consulting Ltd. (“Atticus”) and their strategic partner Caracle Creek Chile SpA (“Caracle”) (together the “Consultants”). This MRE replaces the 2020 mineral resource estimate completed by P&E Mining Consultants Inc. (Stone et al., 2020) which is filed on SEDAR+.

The current MRE for the D-S Deposit was completed in accordance with National Instrument 43-101 (“NI-43-101”), and a technical report in support of the MRE will be filed on SEDAR+ within 45 days from the date of this news release.

Notes to Table 1:

(1) The independent Qualified Person for the MRE, as defined by NI 43-101, is Mr. Simon Mortimer (FAIG #4083) of Atticus Geoscience Consulting Ltd., working with Caracle Creek Chile SpA. The effective date of the MRE is 1 October 2024.

(2) Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

(3) The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

(4) The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration.

(5) The Mineral Resources were estimated following the 2019 CIM Estimation of Mineral Resources & Mineral Reserves Best Practice Guidelines prepared by the CIM Mineral Resource & Mineral Reserve Committee and the 2014 CIM Definition Standards for Mineral Resources & Mineral Reserves prepared by the CIM Standing Committee on Reserve Definitions.

6) Geological and block models for the MRE used core assays (497 samples from 2021 drilling) and data and information from 273 surface diamond drill holes (16 from Class 1 Nickel and 257 historical). The drill hole database was validated prior to resource estimation and QA/QC checks were made using industry-standard control charts for blanks, core duplicates and commercial certified reference material inserted into assay batches by Class 1 Nickel.

7) The block model was prepared using Micromine 2020. A 6 m x 6 m x 6 m block model was created, with sub blocks to 0.5 m x 0.5 m x 0.5 m. Drill composites of 1.0 m intervals were generated within the estimation domains, and subsequent grade estimation was carried out for Ni, Cu and Co using Inverse of distance Weighting interpolation method.

8) Grade estimation was validated by comparison of input and output statistics (Nearest Neighbour), swath plot analysis, and by visual inspection of the assay data, block model, and grade shells in cross-sections.

9) As a reference, the average estimated density value (specific gravity) within the mineralised domain is 2.90 g/cm3 (t/m3).

(10) Estimates have been rounded to 3 significant figures for Indicated resources and 2 significant figures for Inferred resources.

(11) The MRE considers a geological dilution of 5% and a mining recovery of 95%.

(12) US$ metal prices of $8.00/lb Ni, $3.25/lb Cu, $13.00/lb Co were used in the NSR calculation with respective process recoveries of 85%, 70%, and 80%; gold, platinum and palladium are not considered in the current NSR calculation.

(13) Pit-constrained Mineral Resource NSR cut-off considers processing, and G&A costs, applying a factor of 5% for mining dilution, that respectively combine for a total of (($45.00 + $5.00) * (1 + 5%)) = C$52.5/tonne processed.

(14) Out-of-pit Mineral Resource (underground) NSR cut-off considers ore mining, processing, and G&A costs that respectively combine for a total of ($46.00 + $45.00 + $5.00) = C$96.0/tonne processed.

(15) The Out-of-Pit Mineral Resource grade blocks were quantified above the $96.0/t cut-off, below the constraining pit shell and within the constraining mineralized wireframes. Additionally, only groups of blocks that exhibited continuity and reasonable potential stope geometry were included. All orphaned blocks and narrow strings of blocks were excluded. The long-hole stoping with backfill mining method was assumed for the Out-of-Pit (underground) MRE calculation.

(16) The NSR calculation is as follows: NSR C$/t = ((Ni% x 199.89) + (Cu% x 66.87) +(Co% x 305.71)) x 95%.

(17) The NiEq% calculation is as follows: NiEq% = (Ni% x 1) + (Cu% x 0.33) + (Co% x 1.53).

Notes to Table 2:

(1) The independent Qualified Person for the MRE, as defined by NI 43-101, is Mr. Simon Mortimer (FAIG #4083) of Atticus Geoscience Consulting Ltd., working with Caracle Creek Chile SpA. The effective date of the MRE is 1 October 2024.

(2), (3), (4) and (5) refer to Notes to Table 1.

6) Geological and block models for the MRE used core assays (497 samples from 2021 drilling) and data and information from 273 surface diamond drill holes (16 from Class 1 Nickel and 257 historical). The drill hole database was validated prior to resource estimation and QA/QC checks were made using industry-standard control charts for blanks, core duplicates and commercial certified reference material inserted into assay batches by Class 1 Nickel.

7) The block model was prepared using Micromine 2020. A 6 m x 6 m x 6 m block model was created, with sub blocks to 0.5 m x 0.5 m x 0.5 m. Drill composites of 1.0 m intervals were generated within the estimation domains, and subsequent grade estimation was carried out for Ni, Cu and Co using Inverse of distance Weighting interpolation method.

(8) refer to Notes to Table 1.

(9) As a reference, the average estimated density value (specific gravity) within the mineralised domain is 2.90 g/cm3 (t/m3).

(10), (11), (12), (13), (14), (15), (16), and (17) refer to Notes to Table 1.

Class 1 Nickel completed its Phase 1 diamond drilling program on the A-D Project in 2021, with 4,382 m in 16 holes (497 core samples) completed at Dundonald South. The updated MRE combines the 2021 drill hole data with historical drilling (45,636.40 m in 257 holes) completed on the D-S Deposit by previous operators including the most recent drilling by Avion Resources (1,352 m in 4 holes, 2007).

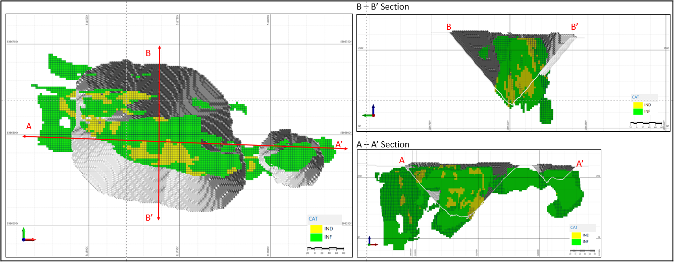

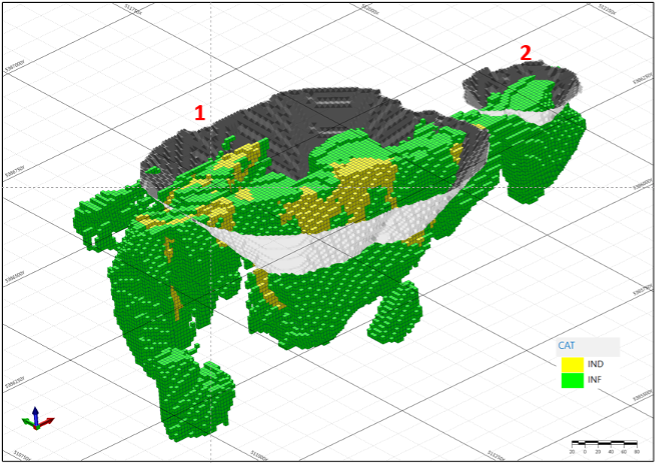

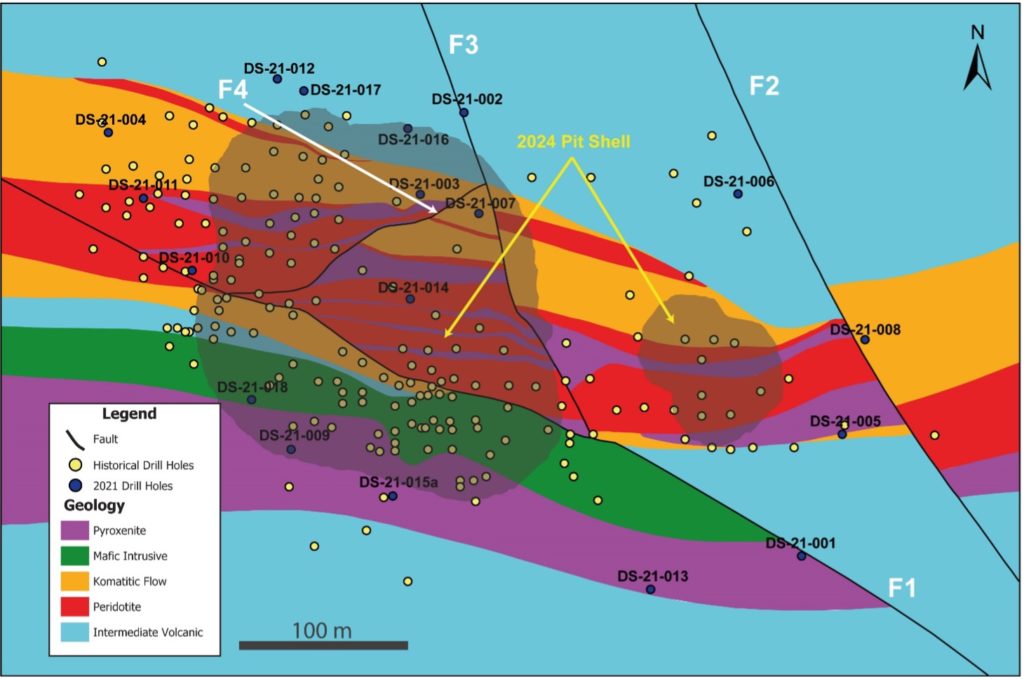

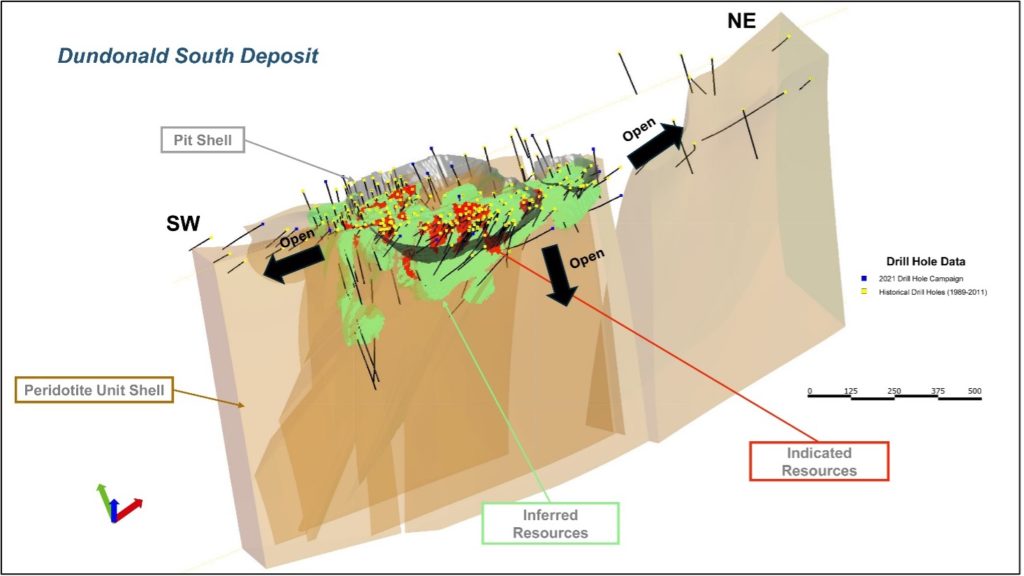

A summary of selected drill core assay intervals from within the medium- and high-grade nickel domains is provided in Table 3, plan view and cross-section views of the current MRE with optimized pit shells are provided in Figure 2 and an isometric view of the categorized mineral resources is shown in Figure 3.

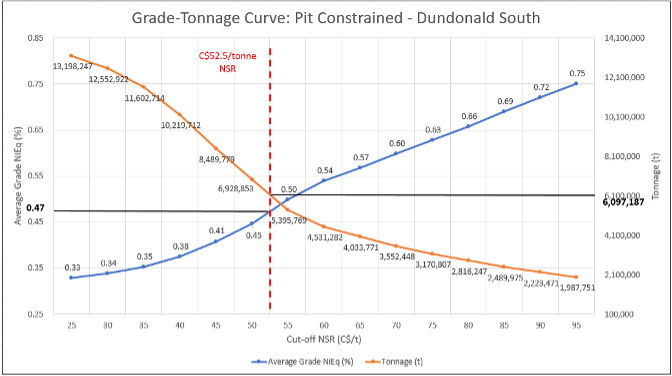

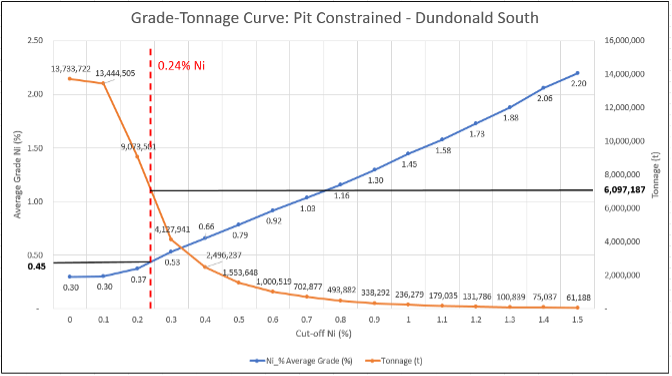

Grade-Tonnage curves for the Pit-Constrained (open pit) mineral resources are provided in Figure 4 (C$/t NSR) and Figure 5 (%Ni) and various views of the Dundonald South Deposit are shown in Figures 6 and 7.

Updates to the mineral resources of the Alexo South and Alexo North deposits were announced 24 April 2024 and 22 May 2024, respectively. Details regarding the new 3D model and re-interpreted Dundonald South Deposit was announced on 23 September 2024. An update to the mineral resource estimate for the Dundonald North Nickel Sulphide Deposit is planned.

Figure 1. Alexo-Dundonald Nickel Sulphide Project showing the location of the 4 nickel deposits and the optimized pit shell outlines for Alexo North and South and Dundonald South deposits, overlain on the generalized geology within the Project. The yellow oval at the Dundonald North Deposit is not an optimized pit shell but rather outlines the approximate area of the 2020 mineral resource estimate reported by Stone et al. (2020).

Figure 2. Plan view (left) and cross-sectional views looking east (right) through the Dundonald South Deposit showing the optimized open pit shells (3D and traces), and the categorized Indicated (yellow) and Inferred (green) mineral resources.

Figure 3. Isometric view (looking northeast) of the Dundonald South Nickel Sulphide Deposit showing the 3D optimized pit shells (1 and 2 in grey) and the Pit-Constrained and Out-of-Pit Indicated (yellow) and Inferred (green) resources.

Figure 4. Grade-tonnage curve for the PIT-CONSTRAINED (open pit) resources (C$/t NSR cut-offs) in the Dundonald South Nickel Deposit. The C$52.50/tonne NSR is highlighted.

Figure 5. Grade-tonnage curve for the PIT-CONSTRAINED (open pit) resources (%Ni cut-offs) in the Dundonald South Nickel Deposit. The 0.24% Ni cut-off grade is highlighted.

Figure 6. Generalized geological plan map of the Dundonald South Deposit, with shaded areas for the optimized pit shells, and 4 labelled faults (F1 to F4) which dissect the deposit. Also shown are the historical drill hole collars (yellow) and the 2021 Class 1 drill hole collars (black).

Figure 7. The updated and interpreted 3D geological model (looking north) showing the categorized Indicated (red) and Inferred (green) mineral resources within and outside of the optimized pit shell that define the D-S Deposit; the Dundonald South Deposit is open along strike and at depth.

As stated in the Company’s recent news releases dated 18 April and 24 April 2024, the primary objectives of the Company are to expand known mineralization and resources at its 4 existing magmatic nickel sulphide deposits within the A-D Project.

Furthermore, the Company will be launching an exploration program to examine the numerous underexplored areas of the Project including the numerous nickel sulphide occurrences that exist outside of the known deposit areas. Much of this exploration will be guided by recently completed airborne geophysics and historical drilling, with new ground geophysics and remote sensing surveys being planned.

Deposit Types and Project Potential

In addition to the high-grade nickel sulphide (>1.0% Ni) potential we see at Alexo-Dundonald, immense potential exists to target and develop large tonnage, low-grade komatiite-hosted deposits such as those being developed in the Timmins area by Canada Nickel Company (Crawford Project), EV Nickel Inc. (CarLang A Deposit) and Aston Minerals Limited (Boomerang Project). The Company is currently planning a targeted diamond drilling program to outline this deposit type within the Alexo-Dundonald Project.

This two-pronged approach – develop “traditional” high-grade nickel sulphide resources and in parallel large-tonnage, low grade nickel deposits – brings together the best of both nickel deposit types which are actively and aggressively being explored for and developed within the Timmins Mining Camp.

Core Handling, Assay and QA/QC Procedures

After visually logging the NQ-size drill core from the 2021 Class 1 Nickel diamond drilling program (Dundonald South Deposit), drill core was cut in half at the core logging and cutting facility with one half of the core bagged and the other half saved in the core tray and put into secure storage. The core samples were transported to either AGAT Laboratories of Mississauga, Ontario (“AGAT”) or ALS Laboratory in Timmins, Ontario (“ALS”). Samples, along with certified standards and blanks, included by the Company for quality assurance and quality control, were prepared and analyzed at AGAT and ALS. Samples were prepped using industry standard procedures and analyzed for nickel, copper, cobalt and sulphur. Analytical methods employed consisted of four-acid digest followed by sodium peroxide fusion and ICP-OES finish for multi-element analysis (including Ni, Cu, Co and S); fire-assay collection and ICP-OES finish for palladium, platinum and gold; and nickel collection fire assay and ICP-MS finish for the platinum-group elements, including rhodium.

Alexo-Dundonald Nickel Sulphide Project

The A-D Project is located about 45 km northeast of the City of Timmins, Ontario, covers an area of approximately 1,895 hectares (18.95 km2), and was acquired by the Company in September 2018. The A-D Project includes four foundation nickel deposits (Alexo North and South and Dundonald North and South) of which the Alexo North and Alexo South (aka Kelex) were small-scale past producers of relatively high-grade nickel (i.e., 1957; 2004-2005). The deposits are located on a near-continuous folded komatiite-ultramafic rock sequence that extends for at least 14 km within the Property and which has never been systematically explored. The 4 mineral resources are open at depth and along strike and could increase in size with additional drilling (see Company’s recent news releases dated 18 April 2024 and 23 September 2024).

Qualified Persons

The Qualified Person, as defined by NI 43-101, for the Dundonald South Mineral Resource Estimate reported herein, Mr. Simon Mortimer (FAIG #4083), Principal Geoscientist at Atticus Geoscience Consulting Ltd. (Cornwall, UK and Lima, Peru). All other technical information and data in this news release has been reviewed and approved by Dr. Scott Jobin-Bevans (P.Geo., PGO #0183), Principal Geoscientist at Caracle Creek Chile SpA and a Qualified Person under the definitions established by NI 43-101.

About Class 1 Nickel

Class 1 Nickel and Technologies Limited (CSE: NICO | OTCQB: NICLF) is a Mineral Resources Company focused on the exploration and development of its 100% owned komatiite-hosted nickel sulphide projects: the Alexo-Dundonald Project, neat Timmins, Ontario (4 nickel sulphide deposits) and the Somanike Project, near Val-d’Or, Quebec (includes the historical Marbridge Ni-Cu Mine). Both projects comprise extensive property packages covering past-producing nickel mines, offering near-term production opportunity and excellent exploration upside.

Class 1 Nickel’s current focus is to continue brownfield and greenfield exploration on its large property packages to aggregate additional nickel resources and in parallel look to advance the A-D Project back into production. The A-D Project sits on a 14+ km strike-length, folded komatiite unit containing several nickel-copper-cobalt and PGE mineral resources plus numerous underexplored sulphide occurrences. Decades of successful capital expenditure and investment into the Project has resulted in the discovery and delineation of four main nickel Mineral Resources that occur along the folded komatiite unit. The A-D Project was previously mined via a direct-shipping model, and the Company will soon commence a Preliminary Economic Assessment (PEA) study to determine the best path forward.

In addition, the Company also holds a 100% interest in its River Valley PGE Project located about 65 km northeast of the City of Sudbury, Ontario, the world’s largest and longest operating nickel-copper-cobalt-PGE mining camp (seeCompany news release dated 13 December 2023).

For more information, please contact:

Mr. David Fitch, President & CEO

T: +61.400.631.608

For additional information please visit our website at www.class1nickel.com and our Twitter feed: @Class1Nickel.

Neither the Canadian Securities Exchange nor its regulation services provider has reviewed or accepted responsibility for the adequacy or accuracy of this press release.

This news release contains forward-looking information which is not comprised of historical facts. Forward-looking information is characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate” and other similar words, or statements that certain events or conditions “may” or “will” occur. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, and opportunities to differ materially from those expressed or implied by such forward-looking information. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, changes in the state of equity and debt markets, fluctuations in commodity prices, delays in obtaining required regulatory or governmental approvals, and other risks involved in the mineral exploration and development industry, including those risks set out in the Company’s management’s discussion and analysis as filed under the Company’s profile at www.sedarplus.ca. Forward-looking information in this news release is based on the opinions and assumptions of management considered reasonable as of the date hereof, including that all necessary governmental and regulatory approvals will be received as and when expected. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information. The Company disclaims any intention or obligation to update or revise any forward-looking information, other than as required by applicable securities laws.