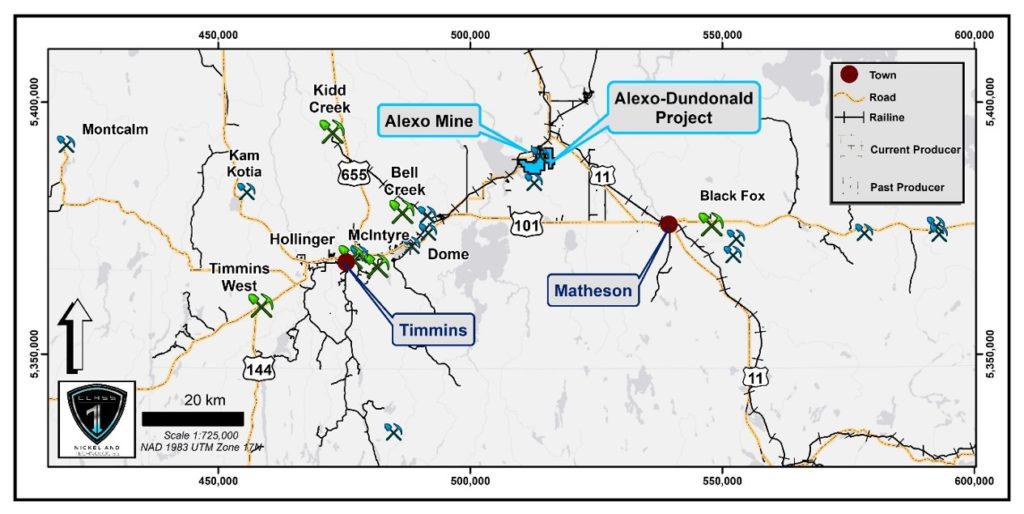

Past-Producing High-Grade Nickel-Copper-Cobalt-PGE Project,

Tier-1 Timmins Camp, Ontario, Canada

Highlights

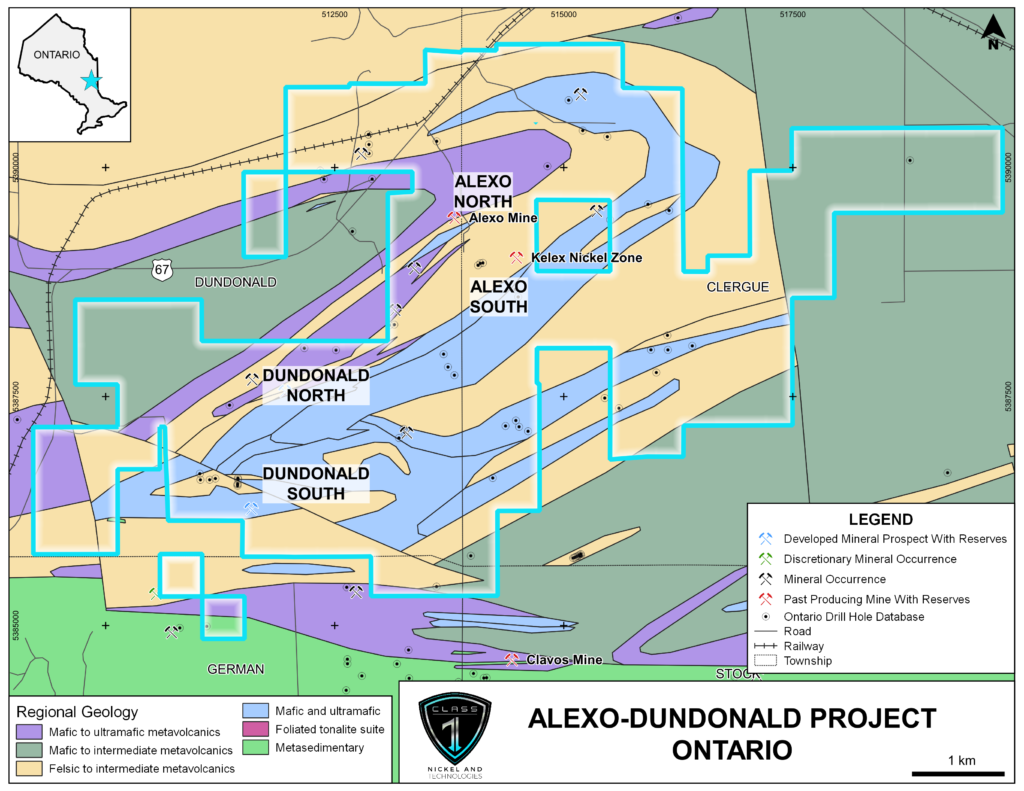

- Situated 45 km northeast of Timmins with year-round road access, proximal to operating processing plants

- Glencore’s Strathcona process plant near Sudbury – 300 km on highway;

- Kidd Metallurgical Site ~30 km on highway;

- Multiple nickel projects in the region, some which are advanced and could provide additional processing options.

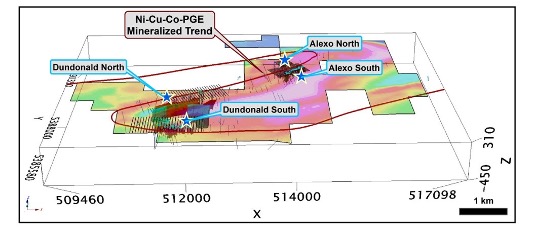

- Alexo-Dundonald Project, which includes four nickel sulphide , covers approximately 3,730 ha (37 km2) and comprises 97 Single Cell Mining Claims, 6 Boundary Cell Mining Claims, and 3 Multi-Cell Mining Claims, along with 29 Patents and 14 Leases.

- The 4 nickel sulphide deposits are the Alexo Mine (past-producing) Alexo-South Mine (past-producing 2004-2005), Dundonald South, and Dundonald North.

- In addition to these 4 deposits, the Property encompasses more than 14 km strike-length of folded and potentially mineralized komatitic rock units.

- Historically, Alexo was a shallow, high-grade nickel sulphide mine, allowing Class 1 Nickel to leverage significant historical exploration and development expenditures to expand mineral resources with the aim of future nickel sulphide production.

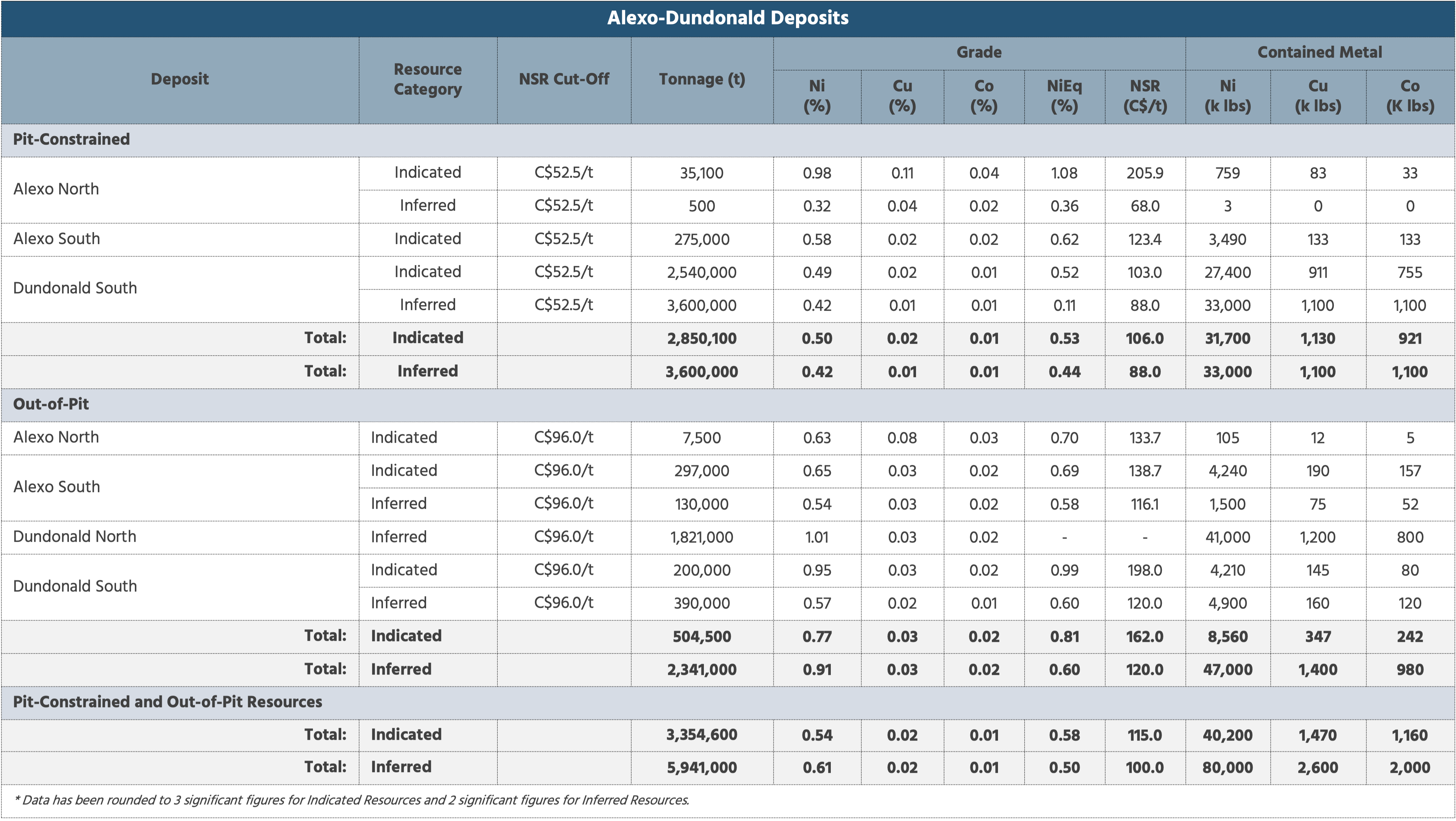

- Total Mineral Resources in the 4 deposits: 3.4 Mt at 0.54% Ni Indicated and 5.9 Mt at 0.61% Ni Inferred

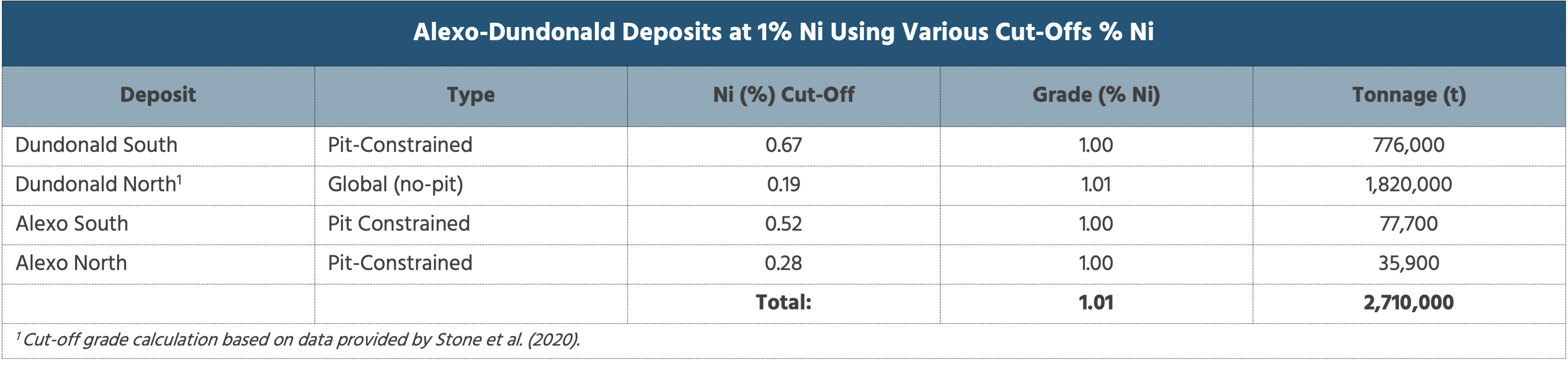

- Total high-grade nickel (<1.0% Ni) within the 4 deposits: 2.71 Mt at 1.01% Ni.

- Given the Project’s historical production profile and existing shallow resources in 4 deposits, Class 1 is well-positioned to advance the Project toward production with an initial Preliminary Economic Assessment (PEA) planned for early 2025.

4 Nickel Deposits within Alexo-Dundonald

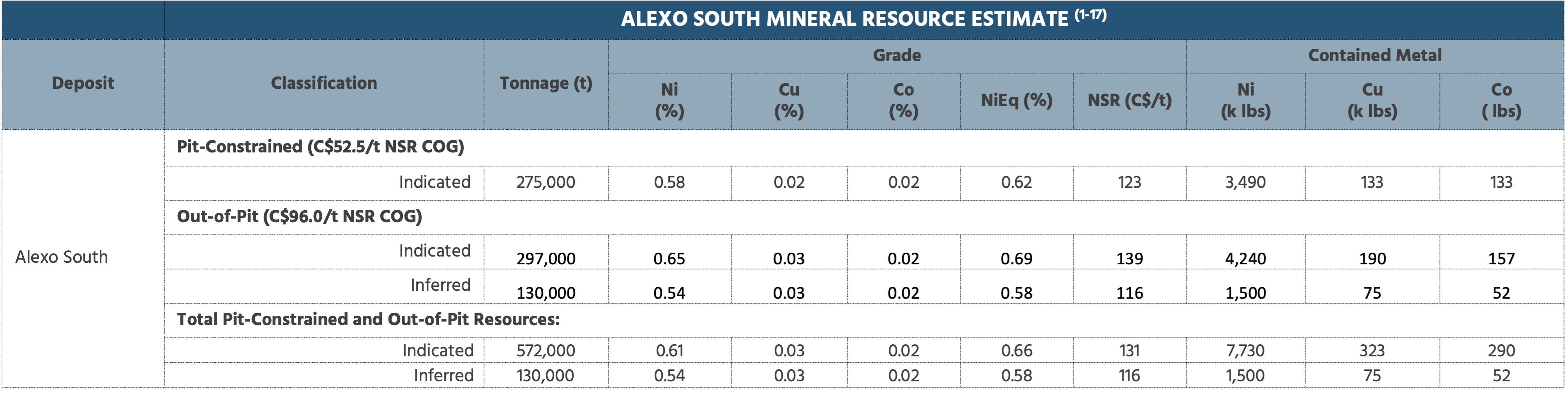

- Indicated Resources of 572 kt at 0.61% Ni (7.7M lbs Ni)

- Inferred Resources of 125 kt at 0.54% Ni (1.5M lbs Ni)

- With only 18% of the Alexo South Deposit tonnes in the Inferred category there is excellent exploration upside to expand and upgrade resources through additional drilling.

- Indicated Resources of 42,600 t at 0.92% Ni (864k lbs Ni)

- Inferred Resources of 500 t at 0.32% Ni (3k lbs Ni)

- With only 1% of the Alexo North Deposit tonnes in the Inferred category there is excellent exploration upside to expand and upgrade resources through additional drilling.

- Indicated Resources of 2.54 Mt at 0.49% Ni (27.4M lbs Ni)

- With 59% of the Dundonald South Deposit tonnes in the Inferred category there is excellent exploration upside to expand and upgrade resources through additional drilling.

Future plans to update Dundonald North MRE

- See notes below to accompany each of the deposits table for Alexo South, Alexo North and Dundonald South Updated Mineral Resources Estimate

Alexo-South Updated Mineral Resource Estimate

- Indicated Resources (open pit and underground*) of 572 kt at 0.61% Ni (7.7M lbs Ni) – 44% increase in Indicated tonnes and 10% increase in nickel pounds.

- Inferred Resources (open pit and underground*) of 125 kt at 0.54% Ni (1.5M lbs Ni) – 693% increase in Inferred tonnes and 419% increase in nickel pounds.

- 84% of the nickel pounds and 82% of the tonnes in Alexo South Deposit Mineral Resource Estimate are in the Indicated category with drilling planned to update to Measured.

- With only 18% of the Alexo South Deposit tonnes in the Inferred category there is excellent exploration upside to expand and upgrade resources through additional drilling.

- Alexo South Deposit, one of 4 deposits on the Alexo-Dundonald Property, is open along strike and at depth, with the new geological model and interpretation providing ample targets for next-stage drilling.

*C$52.5/t NSR open pit and C$96.0/t NSR underground cut-offs applied in current 2024 mineral resource estimate whereas a C$30.0/t NSR open pit and C$90.0/t NSR underground cut-offs were applied in the 2020 mineral resource estimate.

Notes to Table 1:

(1) The independent Qualified Person for the MRE, as defined by NI 43-101, is Mr. Simon Mortimer (FAIG #4083) of Atticus Geoscience Consulting S.A.C., working with Caracle Creek Chile SpA. The effective date of the MRE is 19 April 2024.

(2) Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

(3) The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

(4) The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration.

(5) The Mineral Resources were estimated following the 2019 CIM Estimation of Mineral Resources & Mineral Reserves Best Practice Guidelines prepared by the CIM Mineral Resource & Mineral Reserve Committee and the 2014 CIM Definition Standards for Mineral Resources & Mineral Reserves prepared by the CIM Standing Committee on Reserve Definitions.

(6) Geological and block models for the MRE used core assays (2,254 samples from 2021 drilling and 178 samples from 2024 in-fill core sampling) and data and information from 181 surface diamond drill holes (29 from Class 1 Nickel and 152 historical). The drill hole database was validated prior to resource estimation and QA/QC checks were made using industry-standard control charts for blanks, core duplicates and commercial certified reference material inserted into assay batches by Class 1 Nickel.

(7) The block model was prepared using Micromine 2020. A 6 m x 6 m x 6 m block model was created, with sub blocks to 0.5 m x 0.5 m x 0.5 m. Drill composites of 1.0 m intervals were generated within the estimation domains, and subsequent grade estimation was carried out for Ni, Cu and Co using Ordinary Kriging interpolation method.

(8) Grade estimation was validated by comparison of input and output statistics (Nearest Neighbour and Inverse Interpolation methods), swath plot analysis, and by visual inspection of the assay data, block model, and grade shells in cross-sections.

(9) As a reference, the average estimated density value (specific gravity) within the mineralised domain is 2.89 g/cm3 (t/m3).

(10) Estimates have been rounded to 3 significant figures for Indicated resources and 2 significant figures for Inferred resources.

(11) The historical open pit mined areas were removed from the MRE and the MRE considers a geological dilution of 5% and a mining recovery of 95%.

(12) US$ metal prices of $8.00/lb Ni, $3.25/lb Cu, $13.00/lb Co were used in the NSR calculation with respective process recoveries of 85%, 70%, and 80%; gold, platinum and palladium are not considered in the current NSR calculation.

(13) Pit constrained Mineral Resource NSR cut-off considers processing, and G&A costs, applying a factor of 5% for mining dilution, that respectively combine for a total of (($45.00 + $5.00) * (1 + 5%)) = C$52.5/tonne processed.

(14) Out-of-pit Mineral Resource (underground) NSR cut-off considers ore mining, processing, and G&A costs that respectively combine for a total of ($46.00 + $45.00 + $5.00) = C$96.0/tonne processed.

(15) The out-of-pit Mineral Resource grade blocks were quantified above the $96.0/t cut-off, below the constraining pit shell and within the constraining mineralized wireframes. Additionally, only groups of blocks that exhibited continuity and reasonable potential stope geometry were included. All orphaned blocks and narrow strings of blocks were excluded. The long-hole stoping with backfill mining method was assumed for the out-of-pit (underground) MRE calculation.

(16) The NSR calculation is as follows: NSR C$/t = ((Ni% x 199.89) + (Cu% x 66.87) +(Co% x 305.71)) x 95%.

(17) The NiEq% calculation is as follows: NiEq% = (Ni% x 1) + (Cu% x 0.33) + (Co% x 1.53).

Alexo-North Updated Mineral Resource Estimate

- Indicated Resources (open pit and underground*) of 42,600 t at 0.92% Ni (864k lbs Ni) – 63% increase in Indicated tonnes and 8% increase in nickel pounds.

- Inferred Resources (open pit and underground*) of 500 t at 0.32% Ni (3k lbs Ni) – 100% increase in Inferred tonnes and 100% increase in nickel pounds.

- 6% of the nickel pounds and 99% of the tonnes in Alexo North Deposit Mineral Resource Estimate are in the Indicated category with drilling planned to update to Measured.

- With only 1% of the Alexo North Deposit tonnes in the Inferred category there is excellent exploration upside to expand and upgrade resources through additional drilling.

- Alexo North Deposit, one of the 4 deposits on the Alexo-Dundonald Property, is open along strike, with the new geological model and interpretation providing ample targets for next-stage drilling.

*C$52.5/t NSR open pit and C$96.0/t NSR underground cut-offs applied in current 2024 mineral resource estimate whereas a C$30.0/t NSR open pit and C$90.0/t NSR underground cut-offs were applied in the 2020 mineral resource estimate.

Notes to Table 2:

(1) The independent Qualified Person for the MRE, as defined by NI 43-101, is Mr. Simon Mortimer (FAIG #4083) of Atticus Geoscience Consulting S.A.C., working with Caracle Creek SpA. The effective date of the MRE is 21 May 2024.

(2) For Notes 2 to 17 see “Notes to Table 1”

The updated mineral resource estimates for Alexo South and Alexo North were completed by Caracle Creek Chile SpA (“Caracle”) and their strategic partner Atticus Geoscience Consulting Ltd. (“Atticus”) (together the “Consultants”), replacing the 2020 mineral resource estimates completed by P&E Mining Consultants Inc. (Stone et al., 2020), which is filed on SEDAR+. The current MREs were completed in accordance with National Instrument 43-101 (“NI-43-101”).

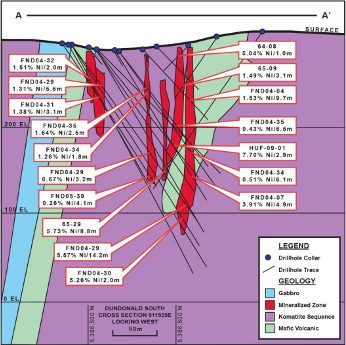

Dundonald South Updated Mineral Resource Estimate

- Indicated Resources (Pit-Constrained*) of 2.54 Mt at 0.49% Ni (27.4 Mlbs Ni) – 781% increase in Indicated tonnes and 474% increase in nickel pounds.

- Dundonald South Deposit contains 776,000 t at 1.0% Ni using a 0.67% Ni cut-off (17.1 Mlbs nickel).

- Total Mineral Resources within 4 deposits: 3.4 Mt at 0.54% Ni Indicated and 5.9 Mt at 0.61% Ni Inferred.

- 87% of the nickel pounds and 41% of the tonnes (Pit-Constrained + Out-of-Pit) in the Dundonald South Deposit are in the Indicated category with drilling planned to update to Measured.

- With 59% of the Dundonald South Deposit tonnes in the Inferred category there is excellent exploration upside to expand and upgrade resources through additional drilling.

- Like the other 3 nickel deposits within the Project, the Dundonald South Deposit is open along strike and at depth, with new geological modelling and interpretation providing ample targets for next-stage drilling.

*C$52.50/t NSR Pit-Constrained and C$96.00/t NSR Out-of-Pit cut-offs applied in current 2024 mineral resource estimates whereas C$30.00/t NSR Pit-Constrained and C$90.00/t NSR Out-of-Pit cut-offs were applied in the 2020 mineral resource estimate (Dundonald North Deposit).

Notes to Table:

(1) The independent Qualified Person for the MRE, as defined by NI 43-101, is Mr. Simon Mortimer (FAIG #4083) of Atticus Geoscience Consulting Ltd., working with Caracle Creek Chile SpA. The effective date of the MRE is 1 October 2024.

(2) Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

(3) The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

(4) The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration.

(5) The Mineral Resources were estimated following the 2019 CIM Estimation of Mineral Resources & Mineral Reserves Best Practice Guidelines prepared by the CIM Mineral Resource & Mineral Reserve Committee and the 2014 CIM Definition Standards for Mineral Resources & Mineral Reserves prepared by the CIM Standing Committee on Reserve Definitions.

(6) Geological and block models for the MRE used core assays (497 samples from 2021 drilling) and data and information from 273 surface diamond drill holes (16 from Class 1 Nickel and 257 historical). The drill hole database was validated prior to resource estimation and QA/QC checks were made using industry-standard control charts for blanks, core duplicates and commercial certified reference material inserted into assay batches by Class 1 Nickel.

(7) The block model was prepared using Micromine 2020. A 6 m x 6 m x 6 m block model was created, with sub blocks to 0.5 m x 0.5 m x 0.5 m. Drill composites of 1.0 m intervals were generated within the estimation domains, and subsequent grade estimation was carried out for Ni, Cu and Co using Inverse of distance Weighting interpolation method.

(8) Grade estimation was validated by comparison of input and output statistics (Nearest Neighbour), swath plot analysis, and by visual inspection of the assay data, block model, and grade shells in cross-sections.

(9) As a reference, the average estimated density value (specific gravity) within the mineralised domain is 2.90 g/cm3 (t/m3).

(10) Estimates have been rounded to 3 significant figures for Indicated resources and 2 significant figures for Inferred resources.

(11) The MRE considers a geological dilution of 5% and a mining recovery of 95%.

(12) US$ metal prices of $8.00/lb Ni, $3.25/lb Cu, $13.00/lb Co were used in the NSR calculation with respective process recoveries of 85%, 70%, and 80%; gold, platinum and palladium are not considered in the current NSR calculation.

(13) Pit-constrained Mineral Resource NSR cut-off considers processing, and G&A costs, applying a factor of 5% for mining dilution, that respectively combine for a total of (($45.00 + $5.00) * (1 + 5%)) = C$52.5/tonne processed.

(14) Out-of-pit Mineral Resource (underground) NSR cut-off considers ore mining, processing, and G&A costs that respectively combine for a total of ($46.00 + $45.00 + $5.00) = C$96.0/tonne processed.

(15) The Out-of-Pit Mineral Resource grade blocks were quantified above the $96.0/t cut-off, below the constraining pit shell and within the constraining mineralized wireframes. Additionally, only groups of blocks that exhibited continuity and reasonable potential stope geometry were included. All orphaned blocks and narrow strings of blocks were excluded. The long-hole stoping with backfill mining method was assumed for the Out-of-Pit (underground) MRE calculation.

(16) The NSR calculation is as follows: NSR C$/t = ((Ni% x 199.89) + (Cu% x 66.87) +(Co% x 305.71)) x 95%.

(17) The NiEq% calculation is as follows: NiEq% = (Ni% x 1) + (Cu% x 0.33) + (Co% x 1.53).

Strong Short-Medium Term Production Potential

- Alexo-Dundonald was previously operated as a direct shipping operation, with last mining completed in 2004/05 for 30.1Kt ore @ 1.92% at an attractive operating cost of just C$1.06 per pound of Ni metal*

-

With a shallow, high-grade Resource, excellent access to existing brownfields infrastructure and local processing facilities, Class 1 Nickel is well-positioned for a mining restart

-

Through utilizing third-party facilities for toll milling, management expect that production of a pre-concentrate can be ramped up quickly with little minimal pre-production capex. Based on assumptions from the previous operations operating costs will be largely limited to mining and haulage*

-

Mineralized material from Alexo was historically processed at Glencore’s Strathcona mill with high metallurgical recoveries. Last year Strathcona Mill had approx. 2,500tpd in excess capacity, which management estimate is more than enough capacity to potentially underpin a highly profitable operation**

-

While Class 1 Nickel is yet to publish a PEA, management have had offtake conversations with top-tier automakers, highlighting the demand for a production restart at Alexo-Dundonald, and the availability of the Nickel Resource

* SEDAR filings of Canadian Arrow Minerals Limited in 2004 and 2005. Operating costs are historical in nature and have not been verified by a Qualified Person.

**Glencore’s 2021 Sudbury INO Production Numbers.